What Are Analysts Estimating for Spirit Airlines in 2016?

Of the 15 analysts rating Spirit Airlines’ stock, 80% (12 analysts) have a “buy” rating, 20% (three analysts) have a “hold” rating, and none of the analysts have a “sell” rating.

Aug. 18 2020, Updated 6:31 a.m. ET

Analyst estimates

Following Spirit Airlines’ (SAVE) 4Q15 earnings release, analysts’ consensus 1Q16 estimates remain unchanged. Sales are expected to grow by 7% at $528 million.

However, given the expected margin decline, analysts are estimating EBITDA (earnings before interest, tax, depreciation, and amortization) is expected to decline by ~1% to $124 million. Both EBITDA and sales growth are expected to increase through the rest of 2016.

For 2016, analysts estimate that Spirit Airlines’ sales will grow by 9% to $2,333 million while EBITDA is expected to grow by 7% to $612 million. Sales growth is expected to increase to 18% for 2017. Growth in profitability is also expected to increase. For 2017, analysts are expecting the airline’s EBITDA to grow by 12%.

Analyst recommendations

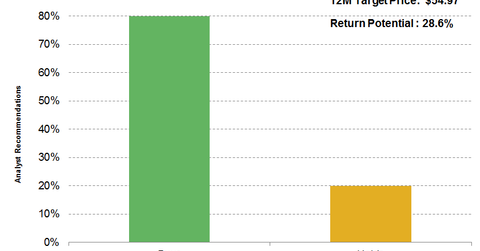

Of the 15 analysts rating Spirit Airlines’ (SAVE) stock, 80% (12 analysts) have a “buy” rating, 20% (three analysts) have a “hold” rating, and none of the analysts have a “sell” rating.

Target price

The stock’s consensus 12-month target price is $54.97, which indicates a 28.6% return potential. Analysts’ 12-month target prices for SAVE’s peers are as follows:

- American Airlines (AAL) $52.42 with 44.9% return potential

- Delta Air Lines (DAL) $65.71 with 56.5% return potential

- JetBlue Airways (JBLU) $28.46 with 41.7% return potential

- United Continental (UAL) $75.61 with 62.7% return potential

- Southwest Airlines (LUV) $54.14 with 53.6% return potential

- Alaska Air Group (ALK) $90.75 with 38.3% return potential

Investors can gain exposure to airline stocks by investing in the iShares Transportation Average ETF (IYT), which invests ~24% of its portfolio in airlines. Next, we will wrap up this series by looking at SAVE’s valuation compared to its peers.