Airline Relative Valuations: What Is Priced In?

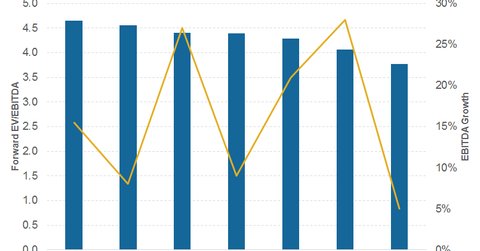

The airline industry is capital-intensive, with high levels of depreciation and amortization and varying degrees of debt and operating leases. To neutralize these factors, we use the EV-to-EBITDA ratio to value airline stocks.

Nov. 20 2020, Updated 2:56 p.m. ET

EV-to-EBITDA multiple

Airlines are capital-intensive, with high levels of depreciation and amortization and varying degrees of debt and operating leases. To neutralize both of these factors, we use the EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratio to value airline stocks. The forward EV-to-EBITDA ratio shows what investors are willing to pay for the next four quarters of estimated EBITDA.

Current valuation

Southwest Airlines (LUV) currently has the highest forward EV-to-EBITDA multiple of 4.65x among its peers. Spirit Airlines (SAVE) has a multiple of 4.56x. Delta Air Lines (DAL) and Alaska Air Group (ALK) both have a 4.4x multiple. American Airlines (AAL) has a multiple of 4.3x, and JetBlue Airways (JBLU) and United Continental (UAL) have multiples of 4x each.

For 2016, analysts are estimating that JBLU should record the highest EBITDA growth of 28%, followed by DAL at 27% and AAL at 21%. LUV is expected to record an EBITDA growth of 16%, ALK should have an EBITDA growth of 9%, SAVE should have an EBITDA growth of 8%, and UAL is expected to the lowest EBITDA growth of 5%.

Investors can gain exposure to airline stocks through the SPDR S&P Transportation ETF (XTN).

Our analysis

Valuation multiples depend on how risky investors seem to think a particular stock is and what are they willing to pay for it. For example, 2011 and 2012 were years of global bear markets due to high inflation in Europe and weakness in emerging markets. The airline industry’s valuation was also at historical lows during this period.

To assess the riskiness of investing in airline stocks, investors should track key indicators. Some company-specific metrics include expected future EBITDA growth, high leverage, and future margins, especially as analysts are now expecting airline margins to have peaked.

Investors should also keep an eye on the industry situation, as industry fundamentals also impact the company’s valuation multiple. Airline industry fundamentals have seen tremendous improvements in the last two years. If industry fundamentals deteriorate or investors’ appetite for risk falls, valuation multiples can fall, too.

On the other hand, an improving global travel and economic outlook would be a huge positive. Investors should watch for those signs by following our industry insightsMarket Realist Airlines.

A fuel price increase may be one such risk. Since fuel is a major expense for the airline industry, rising fuel costs would have an immediate impact on profitability if airlines cannot pass these costs to their passengers. This would adversely affect valuations.

We provide regular updates on these factors, which you can discover on the industry insightsMarket Realist Airlines page.