What Are the Factors Driving Housing Affordability?

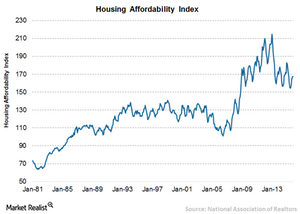

Housing affordability took a beating in July 2015 after reaching its high in January 2013. The higher ratio of the home affordability index signifies relatively higher home affordability to buyers.

Jan. 27 2016, Updated 3:06 p.m. ET

Housing Affordability Index

The National Association of Realtors (or NAR) devised a composite Housing Affordability Index (or HAI), which is published on a monthly basis. The HAI measures the median household income in proportion to the income required to purchase a median-priced house.

Dynamic index

The HAI helps us to track whether the housing is becoming affordable for the typical household during a given timeframe. The National Association of Realtors often incorporates the changes in HAI in key variables affecting affordability such as housing prices, interest rates, and income, thereby reflecting the true picture of the current scenario.

Declining home affordability

As shown in the chart above, housing affordability took a beating in July 2015 after reaching its high in January 2013. The higher ratio of the home affordability index signifies relatively higher home affordability to buyers.

A ratio of 100 indicates that the median family income is barely enough to purchase a median-priced home. On the other hand, the ratio below 100 signifies that the typical household has insufficient income to purchase the median-priced home. The ratio was below 100 until 1986, indicating that housing was unaffordable to a majority of potential homeowners. After 1986, the ratio was consistently above the 100 mark.

Factors driving affordability

After January 2013, housing affordability declined sharply to 154.5 in July 2015, which has been a concern for many buyers in the market. So, what are the factors driving affordability?

Affordability depends to a large extent on the prevailing mortgage rates. The decline in mortgage rates, especially after the housing crisis, led to affordability increasing to its higher level. Other significant factors driving affordability are the prevailing home prices and median household income. When home prices rise sharply compared to median household income, then affordability declines.

Implications

The rising home prices could bode well for homebuilders like Lennar Corp. (LEN), D.R. Horton (DHI), and PulteGroup (PHM), as this could lead to improvement in their EBITDA margins.

Investors can take exposure to the residential real estate sector by investing in residential REITs like Equity Residential (EQR). The iShares Cohen & Steers REIT ETF (ICF) invests 6.7% of its portfolio in Equity Residential (EQR).

In the next part of this series, we’ll discuss affordability issues in the regional markets.