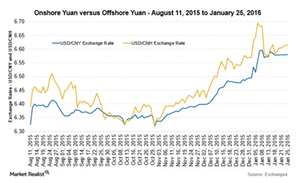

Spread Reducing between Onshore and Offshore Yuan

The spread between the offshore and onshore yuan creates arbitrage opportunities for traders as the value diverges between the two currencies.

Nov. 20 2020, Updated 11:57 a.m. ET

Onshore and offshore yuan

In 2004, the Chinese economy started to use the yuan outside the mainland for settling trade settlements internationally. The premise behind the move was that the PBoC (People’s Bank of China) didn’t want to expose its capital account. It wanted to protect the onshore yuan from volatility arising from market fluctuations. The onshore yuan (CNY) is allowed to trade within a tight band that’s decided by the PBoC. The offshore yuan (CNH) is allowed to trade freely. Hong Kong was the first base to create an offshore market for the yuan. The Bank of China (Hong Kong) was designated for yuan transactions internationally. The offshore yuan market slowly expanded through European and Asian countries (AIA) like Singapore, Taiwan, and South Korea. Dim sum bonds are the bonds issued off the Chinese mainland. Growth in the bond market increased its use on a global basis. The spread between the offshore and onshore yuan creates arbitrage opportunities for traders as the value diverges between the two currencies.

Recent rise in the reserve requirement ratio

China (FXI) decided to implement an RRR (reserve requirement ratio) for deposits made in the yuan by banks in offshore locations. The move is expected to reduce volatility in the value of the yuan and allow the PBoC to effectively manage inflows and outflows from the Chinese economy. The reduction in the available liquidity of the yuan in the market is expected to appreciate its value and slow the recent forces warranting devaluation of the yuan. The current ratio stands at zero. The central bank expects to move it closer to normal levels.

In mainland China, the RRR requires larger banks to keep 17.5% of deposits in the yuan. It requires 15.5% for smaller banks. The PBoC’s moves stem from the growing acceptance of the yuan overseas after the inclusion in the elite special drawing rights basket of currencies by the International Monetary Fund. The flexibility of the PBoC in altering the value of the onshore yuan is expected to reduce as the currency gains wider acceptance. The spread is expected to reduce between the onshore and offshore yuan. These capital controls will also help reduce the central bank’s reliance on foreign exchange reserves and stem unusual volatility in Chinese stock markets (ACH) (NTES) (CBPO).