NetEase Inc

Latest NetEase Inc News and Updates

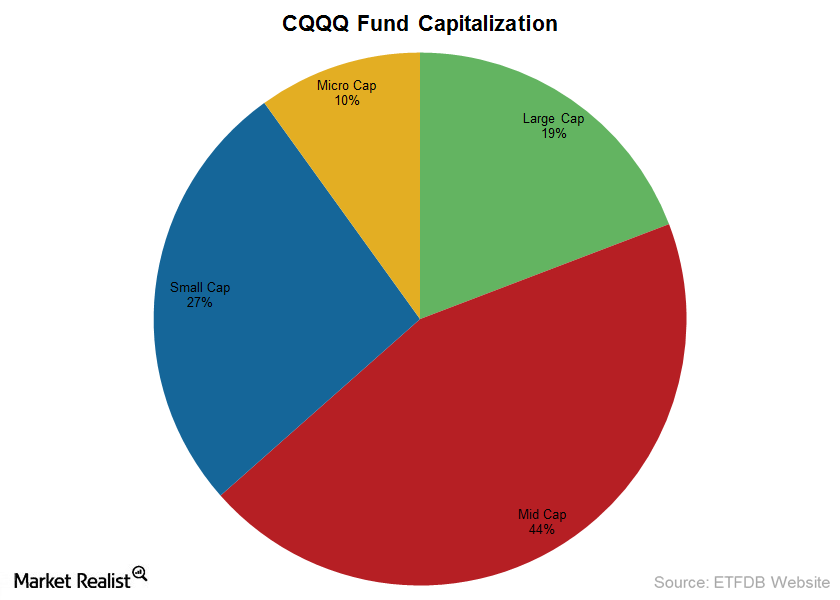

An Analysis of the Guggenheim China Technology ETF (CQQQ)

The Guggenheim China Technology ETF (CQQQ) is a passive fund that looks to replicate the AlphaShares China Technology Index.

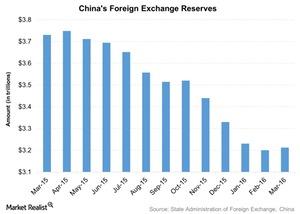

Did China End Its 4-Month Decline in Foreign Reserves in March?

China’s State Administration of Foreign Exchange, or SAFE, released foreign reserve data for March on April 7, 2016. China’s foreign reserves rose $10.3 billion to $3.2 trillion in March.

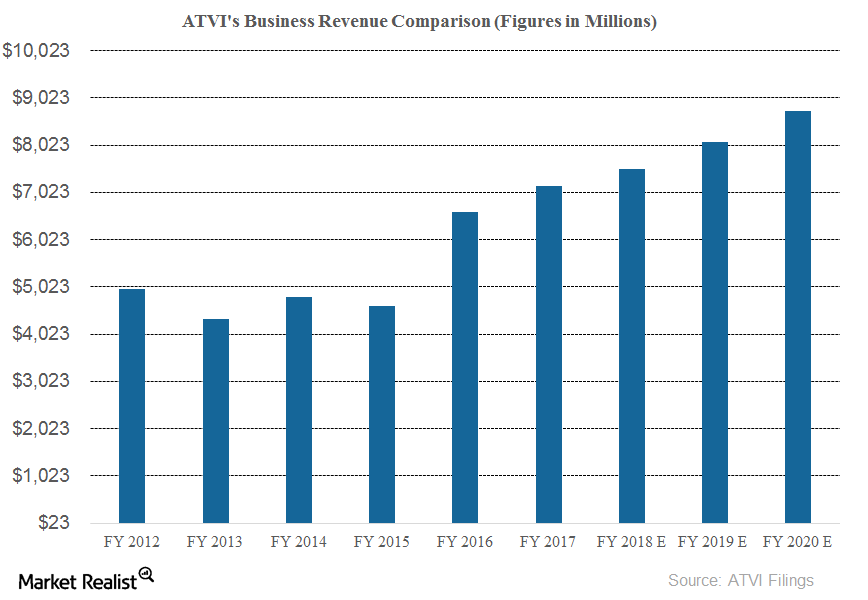

Why Activision Blizzard’s Revenues Are Expected to Rise in Fiscal 2018

Analysts expect Activision Blizzard’s (ATVI) revenues to rise 10.8% YoY (year-over-year) to $1.33 billion in 1Q18.

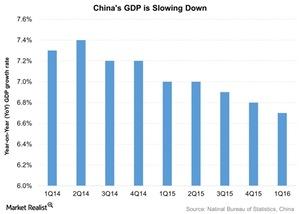

Why Did China’s GDP Grow in 1Q16?

According to the NBS (National Bureau of Statistics of China), China’s GDP grew 6.7% in 1Q16.Macroeconomic Analysis NCEAX: Robust 4Q15 but Dismal YTD Performance

The Neuberger Berman Greater China Equity Fund – Class A (NCEAX) adopts the value-bias strategy, and its objective is to seek long-term capital return in up and down markets.