How Does NMM’s Stock Compare with Its Adjusted Net Asset Value?

Navios Maritime Partners’ adjusted NAV (net asset value) shows that it is currently trading at a 46% discount to its NAV.

Feb. 12 2016, Updated 12:04 a.m. ET

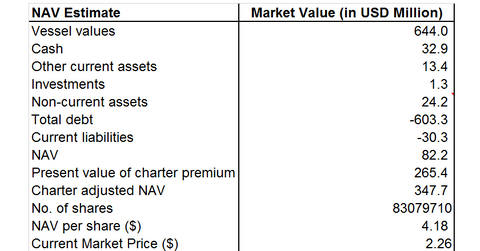

Values of assets and liabilities

In part four of this series, we arrived at vessel values of $644 million for Navios Maritime Partners (NMM). This value is 52% of the book value of vessels recorded by the company at the end of 3Q15. By adding other assets, we arrive at a current value of total assets of $716 million. Total liabilities amount to $633.6 million. This gives us the NAV (net asset value) per share without the charter adjustment of $1.

Adjusted net asset value

In our previous article, we arrived at the present value of $265 million for Navios Maritime Partners’ (NMM) market charters. As they are of value to anyone acquiring these contracts, we’ll add this to the company NAV to arrive at the charter-adjusted NAV of $348 million, or $4.18 per share. On January 26, 2016, NMM’s stock price was $2.26. The adjusted NAV shows that NMM is currently trading at a 46% discount to its NAV.

As we’ve previously discussed, while freight rates and vessel values could go lower in the short term, over a longer period, they should rebound as owners can’t operate at these levels sustainably. This means that while the downside for the company’s stock price from here could be limited, there could be a significant upside. NMM’s management has a good execution record. Its relatively lower costs, low leverage, and high coverage on container ships support dividends (DVY), which could also add to the upside.

Currently, NMM’s peers (SEA) Diana Shipping (DSX), Safe Bulkers (SB), Scorpio Bulkers (SALT), and Navios Maritime Holdings (NM) are also battling a depressed freight rate environment. To learn more about which companies can endure this downturn, please visit Which Dry Bulk Companies Can Endure the Prolonged Downturn? NM and NMM form 1.8% and 1.9%, respectively of SEA’s holdings.

Risk perception

As the risk assessment could differ based on perception, we’ll provide sensitivities of the premium for different discount rate scenarios in our next article. We’ll also see how the changes in vessel values could impact NMM’s NAV.