Scorpio Bulkers Inc

Latest Scorpio Bulkers Inc News and Updates

What Do Fundamental Bulk Shipping Indicators Say?

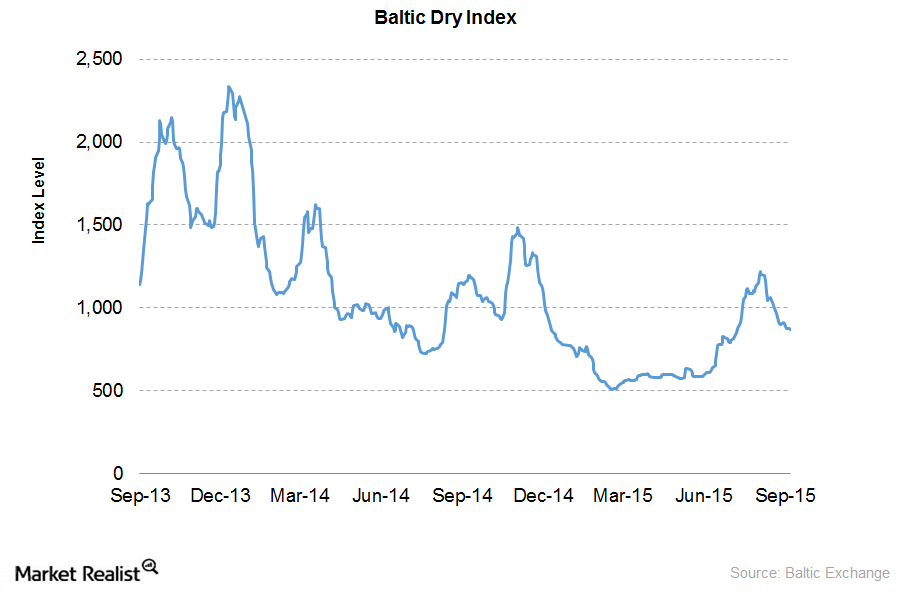

The BDI (Baltic Dry Index) is a leading indicator for the bulk shipping industry. It’s a measure of the cost of shipping major bulk commodities on a number of shipping routes.

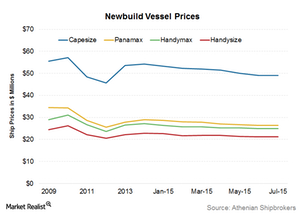

Newbuild Vessel Prices Remained Steady in July

Newbuild vessel prices for all of the ship sizes remained constant in July 2015—compared to June 2015—according to data from Athenian Shipbrokers.