Indirect Bidders Participated in the 13-Week T-Bills Auction

The U.S. Department of the Treasury auctioned 13-week T-bills worth $28 billion on April 11. The offer amount of these bills was the same as the previous auction.

April 22 2016, Updated 9:08 a.m. ET

13-week T-bills auction

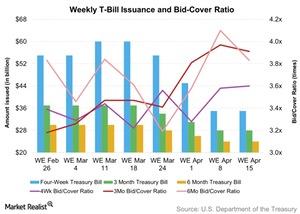

The U.S. Department of the Treasury auctioned 13-week Treasury bills, or T-bills, (BIL) (MINT) worth $28 billion on April 11. The offer amount of these bills was the same as the previous auction.

The overall auction demand fell by 1.5% in the week. The bid-to-cover ratio fell to 3.91x from 3.97x a week ago. So far, in 2016, the ratio averaged 3.51x. The bid-to-cover ratio measures the overall demand for the auction.

Mutual funds like the MassMutual Select Strategic Bond Fund – Class A (MSBAX) and the MFS Government Securities Fund – Class A (MFGSX) – have exposure to T-bills.

Yield analysis

T-bills don’t pay a coupon. They’re offered at a discount to face value. They’re redeemable at par on maturity. The high discount rate for the April 11 auction came in at 0.23%—a bit lower than 0.24% the previous week.

Market demand rose

Market demand for 13-week T-bills rose to 48.7% from 40.0% in the previous week. The percentage of indirect bids rose to 40.4% of the accepted bids from 33.1% a week ago. Indirect bids show the demand from foreign governments.

Direct bids rose. These bids formed 6.9% of accepted bids in the previous week. They rose to 8.3% last week. Direct bidders include domestic money managers—for example, State Street (STT) and BlackRock (BLK).

Due to a rise in the overall market demand, the share of primary dealer bids fell to 51.3% from 60.0% in the previous week. Primary dealers are a group of 22 broker-dealers authorized by the Fed. They’re obligated to bid at US Treasury auctions and take up the excess supply. They include firms like Goldman Sachs (GS) and Citigroup (C). A fall in the percentage of primary dealer bids shows strong fundamental market demand.