MassMutual Select Strategic Bond Fund Class A

Latest MassMutual Select Strategic Bond Fund Class A News and Updates

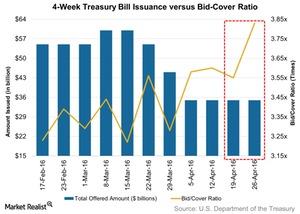

Fundamental Market Demand Rose for 4-Week Treasury Bills Auction

The US Department of the Treasury conducted the weekly auction of four-week Treasury bills (or T-bills) on April 26.

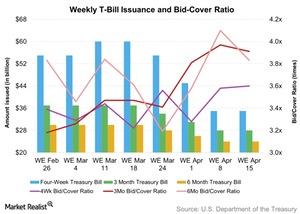

Indirect Bidders Participated in the 13-Week T-Bills Auction

The U.S. Department of the Treasury auctioned 13-week T-bills worth $28 billion on April 11. The offer amount of these bills was the same as the previous auction.