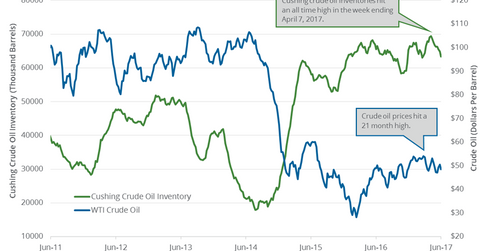

Cushing Crude Oil Inventories Fell Again

A recent survey estimated that inventories at Cushing could have fallen on June 2–9, 2017. Inventories at Cushing fell for the seventh time in ten weeks.

June 12 2017, Published 11:14 a.m. ET

Cushing crude oil inventories

A recent survey estimates that inventories at Cushing could have fallen on June 2–9, 2017. Inventories at Cushing fell for the seventh time in the last ten weeks. Inventories have fallen by 4.4 MMbbls (million barrels) in the last ten weeks. A fall in inventories at Cushing could support US crude oil (ERY) (ERX) (USO) prices.

Lower crude oil prices have a negative impact on oil and gas producers like exploration and production companies’ profitability like Apache (APA), Noble Energy (NBL), Carrizo Oil & Gas (CRZO), and Cobalt International Energy (CIE).

EIA’s crude oil inventory report

At 10:30 AM EST on June 14, 2017, the EIA (U.S. Energy Information Administration) will release its weekly crude oil inventory report for the week ending June 9, 2017.

In its previous report, the EIA reported that Cushing crude oil inventories fell 2.2% to 63.3 MMbbls. Inventories have fallen 3.2% year-over-year.

Cushing’s storage capacity

Cushing, Oklahoma, is the largest crude oil storage hub in the US. Cushing’s crude oil storage capacity is 73 MMbbls.

Impact

Inventories at Cushing have fallen 8.7% from their peak level. The expectation of fall in inventories could benefit crude oil prices this week. Likewise, the expectation of a fall in US crude oil inventories on June 2–9, 2017, could also support oil prices this week. For more on nationwide crude oil inventories, read Surprise Build in US Crude Oil Inventories Hurt Oil Prices.

Next, we’ll analyze the US crude oil rig count last week.