AMFQX: More Than 60% Exposure to Derivative Securities

AMFQX is an alternative mutual fund that seeks to generate positive absolute returns with a low correlation to the returns of broad stock and bond markets.

Nov. 20 2020, Updated 4:39 p.m. ET

AMFQX’s investment objective

The 361 Managed Futures Strategy Fund – Investor Class (AMFQX) is an alternative mutual fund that seeks to generate positive absolute returns that have a low correlation to the returns of broad stock and bond markets. The fund employs a proprietary investment methodology that uses a systematic trading model take positions—long, short, or cash—in US equity index futures. The fund was managing assets worth $816 million as of the end of December 2015. The graph below gives the portfolio holdings breakdown of the AMFQX.

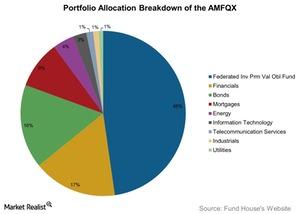

Portfolio breakdown

The major components of the AMFQX include derivative contracts in the financials, energy, and information technology sectors, among others. More than 60% of the fund’s exposure is to derivative securities. Almost 48% of the fund’s net assets are invested in a subsidiary fund that invests in the trading companies that employ its managed futures strategy. Other top holdings of the fund include floating-rate notes of Bank of America (BAC), Kansas City Southern (KSU), Morgan Stanley (MS), and General Electric (GE). The fund’s overall portfolio duration is expected to be less than one year, with a weighted average maturity of fewer than two years as defined by its principal investment strategies.

Use of quantitative models

The fund makes use of the popular “managed futures” hedge fund strategy to achieve its investment objective. The fund employs a set of quantitative models that use a combination of market inputs and take investment decisions unlike traditional market indexes such as the S&P 500 Index (VFINX).

According to the fund’s prospectus, “the AMFQX will primarily seek to establish both long and short positions in futures contracts on the various US and foreign equity indices.” A long position is entering into a contract to buy a particular asset at a future date, with the expectation that the asset will rise in value. A short position is opposite to the long position, where the expectation is bearish.

A significant portion of the AMFQX’s net assets is required to be kept as a margin for its futures positions. The amount of this depends on the notional value of the contracts held by the fund. In additional to that, the fund also holds mortgage-backed fixed income securities and corporate bonds as collaterals to its derivative positions to generate interest income for its investors.

A detailed study of the fund’s investment methodology is given in the next article.