What the Brent–WTI Spread Indicates

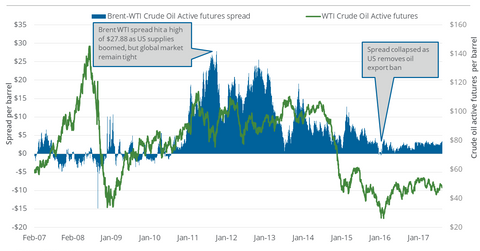

On August 15, Brent crude oil active futures were trading $3.25 more than the WTI crude oil active futures. On August 8, the spread stood at $2.97.

Nov. 20 2020, Updated 4:43 p.m. ET

Brent–WTI spread

On August 15, 2017, Brent crude oil (BNO) active futures were trading $3.25 more than the WTI (West Texas Intermediate) crude oil (UCO) (USO) active futures. On August 8, 2017, the spread was $2.97.

How the Brent–WTI spread measures market sentiment

On December 1, 2016, the day after OPEC announced its production cut deal on November 30, the Brent–WTI spread doubled compared to the previous trading session. The jump in the spread could have resulted from the reduced global crude oil supply. Relatively higher oil prices and a production cut by global oil exporters could increase US crude oil production.

However, a similar sharp move in the spread was not observed during OPEC and non-OPEC members monitoring team meeting on July 24, 2017. In July 2017, OPEC oil production rose to ~32.9 million barrels per day above the pledged output level of 32.5 million barrels per day.

US crude oil exports

The Brent–WTI spread is crucial for US crude oil exports. If the spread covers US crude oil storage and transportation costs, then exports could be profitable.

When the spread rises, it could mean lower domestic prices for US crude oil producers (XOP) (DRIP) than their international peers. The rise in the spread could be profitable for US refineries (CRAK), as their input costs fall when output prices are relatively high.

For updates related to crude oil, please visit our Energy and Power page.