State of the Jewelry Industry in 2015: Growth and Challenges

Trends shaping the jewelry industry include Increasing demand for branded jewelry and an increased focus on e-commerce sales.

Nov. 20 2020, Updated 2:56 p.m. ET

Jewelry industry growth

According to the U.S. Department of Commerce, between 2010 and 2015, total jewelry and watch sales in the United States have grown at a CAGR (compounded annual growth rate) of 4.4%, reaching $74.7 billion in 2014.

The United States, the most mature jewelry market, reported a 7% rise in jewelry sales in 2014, followed by China and India with rises of 6% and 3%, respectively. Tiffany & Co. (TIF) has a strong presence in all these mature and growing markets.

In-house credit facility represents 35%–50% of total jewelry sales. However, Tiffany and its peer Fossil (FOSL) don’t offer credit facility to their customers, unlike Signet Jewelers (SIG), where credit sales account for 41.9% of total sales.

Tiffany, Signet, and Fossil all have exposure in the iShares Russell 1000 Growth ETF (IWF), which is a growth-oriented ETF. Together, these companies make up 0.12% of the portfolio holdings of IWF.

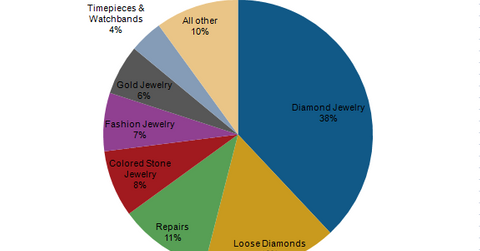

What do jewelry consumers buy?

According to the Survey of America, 37.9% of jewelry sold is diamond jewelry, with loose diamonds contributing another 16% of sales. Fashion and gold jewelry account for 7% and 6% of total sales, respectively.

Trends shaping the jewelry industry

- Increasing demand for branded jewelry due to distinctive designs, credibility, and quality

- Increase in jewelry shops in developing countries of Asia

- Increased focus on e-commerce sales in both developed and developing markets

Previously, the holiday season in November and December accounted for no less than 30% of total jewelry and watch sales. However, since 2008, this trend has been changing, and jewelry purchases have been more evenly spread throughout the year. In 2014, holiday sales represented 27.9% of total annual jewelry and watch sales.

Challenges of jewelry industry

The retail jewelry market is highly dependent on macroeconomic factors. When the macroeconomic environment becomes unfavorable, it affects the luxury sector the most.

In 2014, the retail jewelry industry (XRT) faced the challenge of price deflation and slow sales. This resulted in lower margins for both retailers and suppliers, and these lower prices could not attract consumers, affecting sales.