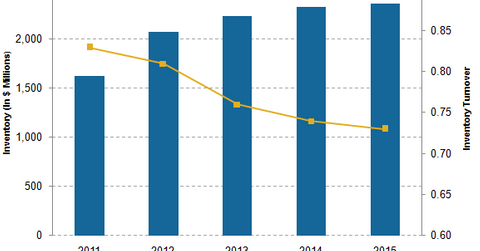

Low Inventory Turnover Is a Concern at Tiffany & Co.

At the end of fiscal 2015, Tiffany had a total inventory of $2.4 billion and inventory turnover of 0.73x, implying potential low sales and excess inventory.

Dec. 15 2015, Updated 11:05 a.m. ET

Raw material

The main inputs for the jewelry industry are diamonds, gold, and other precious and semi-precious metals and stones. At Tiffany & Co. (TIF), diamond sales accounted for 58%, 58%, and 55% of total company sales in fiscal 2015, 2014, and 2013, respectively.

Low inventory turnover is a concern at Tiffany

At the end of fiscal 2015, ended January 31, 2015, Tiffany had a total inventory of $2.4 billion, with an inventory turnover of 0.73x. Inventory turnover shows how many times a company’s inventory is sold.

Tiffany’s peers in the jewelry industry (XRT), Signet Jewelers (SIG) and Fossil (FOSL), had inventory turnovers of 1.9x and 2.6x, respectively, over the same period. A low turnover compared to its peers may imply low sales and excess inventory for Tiffany. Signet’s visual merchandising model minimizes the risk of less or excess inventory.

Tiffany, Signet, and Fossil all have exposure in the iShares Russell 1000 Growth ETF (IWF). Together, they make up 0.12% of the portfolio holdings of IWF, which is a growth-oriented ETF.

Manufacturing facilities

Tiffany has jewelry manufacturing operations in New York, Rhode Island, Thailand, and Kentucky, and a jewelry polishing facility in the Dominican Republic. The company has processing, cutting, and polishing facilities outside of the United States.

Using these internal manufacturing facilities, Tiffany produces more than half of its merchandise sold. Tiffany does not expect to manufacture all of its merchandise, but plans to increase its percentage of internally manufactured jewelry in the future.

65% to 75% (by value) of the polished diamonds used in Tiffany’s jewelry have been produced from the rough diamonds that the company has purchased.