The Life Cycle of Oil and Gas Reserves: Tracking the Activities of Upstream Companies

The depletion of reserves due to production and rising demand continually creates a need for the exploration of new oil and gas reserves.

Dec. 8 2015, Updated 8:07 a.m. ET

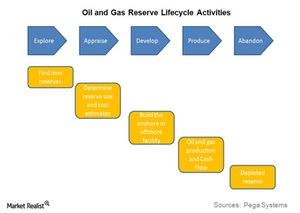

Oil and gas reserve lifecycle

In this part of our series, we’ll examine the typical oil and gas reserve life-cycle activities of upstream energy companies.

Exploration phase

The depletion of reserves due to production and rising demand continually creates a need for the exploration of new oil and gas reserves. This phase involves geological, geophysical, and geochemical analysis using sophisticated software and technologies, such as advanced 3D seismic technology. We should bear in mind, however, that not all upstream companies have the in-house capabilities for this phase, so many companies tend to engage with other oil service companies that have special competencies in these areas. Exploration is a highly costly activity as not all exploration activities result in success.

Appraisal phase

In this phase, estimates are made about the size of an underlying oil or gas reservoir. In addition, upstream companies also have to determine the following:

- how much oil or gas can be extracted under current market conditions

- cost estimations for a number of different development scenarios

- the particular development process and planning

This is also the phase where capital expenditure decisions are made, and, if required, companies raise capital by way of debt or equity issuance at this stage, before moving on to development.

Development phase

This phase involves the actual building of the necessary facilities. This can be an onshore or offshore facility, depending on the location of the reserve. (We’ll discuss these different types of facilities in next part of this series.)

The development phase involves the detailed engineering and construction of platforms, drilling wells, pipelines, and storage tanks. Because not all upstream companies have the capabilities for these tasks, many tend to engage the oilfield services of companies like Baker Hughes (BHI) and Transocean (RIG) for drilling. This is the phase wherein major capital expenditures take place. Investments needed for this phase can run into the billions of dollars for major facility development.

Production phase

This is the phase where the oil or gas starts to flow from underground reserves. This phase is very important because upstream companies generate their cash flows from this phase. Their focus is thus always to extract as much oil and gas as possible. During this phase, upstream companies also focus on productivity improvement measures.

Understanding abandonment

Once recoverable reserves are extracted, a facility might become uneconomical for further development, at which point it is abandoned. This is particularly true in the case of unconventional resources, wherein well life is relatively short—sometimes as little as a few years.

Companies with upstream energy operations

Major players such as Exxon Mobil Corporation (XOM) and Occidental Petroleum Corporation (OXY) have all or most of the above phases executed by their own in-house departments, whereas relatively smaller players such as Cimarex Energy Company (XEC), EQT Corporation (EQT), and Range Resources Corporation (RRC) engage with oilfield services companies.

Apart from investing directly in these companies, investors can also gain exposure to upstream energy companies like these by investing in the SPDR S&P Oil and Gas Exploration & Production ETF (XOP).

In the next part of this series, we’ll examine these phases individually, beginning with exploration and production.