How Would Kyndrisa Treat Duchenne Muscular Dystrophy?

The FDA advisory committee has given an unfavorable opinion to Kyndrisa. But most analysts estimate the probability of FDA approval for the drug to be about 50%.

Dec. 14 2015, Updated 1:07 p.m. ET

Treatment for Duchenne Muscular Dystrophy

BioMarin Pharmaceutical’s (BMRN) Kyndrisa (drisapersen) targets Duchenne Muscular Dystrophy (or DMD) Amenable to Exon 51 Skipping. According to the drisapersen advisory committee briefing document submitted by BioMarin Pharmacetical to the FDA (U.S. Food and Drug Administration), “Duchenne muscular dystrophy is caused by genetic mutation resulting in the relative absence of functional dystrophin, a rod-shaped protein necessary for the integrity and function of muscle fibers.”

Dystrophin is required to protect the muscles from the stress of contractions. BioMarin Pharmaceutical explains the outcome of the absence of dystrophin as “lack of the muscle isoform of dystrophin results in degeneration of muscle fibers, attracting inflammatory cells, and ultimately replacement of muscle by fibrosis and adipose tissue.” This eventually results in progressive muscle weakening, which affects the patient’s mobility.

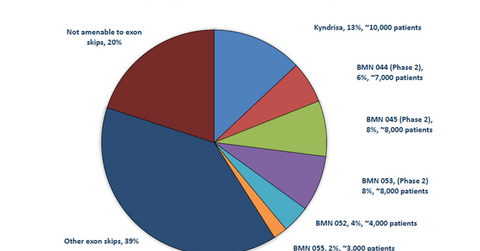

The above diagram shows the breakdown of DMD patients targeted by BioMarin Pharmaceutical’s existing as well as pipeline drugs, segmented by exon.

According to Muscular Dystrophy UK, “Genes are divided into sections called exons and introns. Exons are the sections of DNA that code for the protein and they are interspersed with introns which are also sometimes called ‘junk DNA’. The introns are cut out and discarded in the process of protein production, to leave just the exons. The dystrophin gene is our largest gene- it has 79 exons which are joined together like the pieces of a puzzle.”

Muscular Dystrophy UK further explains the role of exon in DMD: “In Duchenne muscular dystrophy an exon, or exons are deleted which interfere with the rest of the gene being pieced together.”

BioMarin Pharmaceutical plans to treat approximately 45,000 DMD patients with its exon-skipping products. According to Muscular Dystrophy UK, “As the name suggests, the principle of exon skipping is to encourage the cellular machinery to ‘skip over’ an exon. Small pieces of DNA called antisense oligonucleotides (AOs) or ‘molecular patches’ are used to mask the exon that you want to skip, so that it is ignored during protein production.”

BioMarin Pharmaceutical is involved in developing several drugs that address various exon deletions resulting in DMD.

Kyndrisa

BioMarin’s drisapersen briefing document describes Kyndrisa (drisapersen) as follows: “Drisapersen is a chemically modified RNA oligonucleotide with a sequence optimized to specifically bind and skip exon 51 in the dystrophin pre-mRNA, allowing synthesis of an internally shortened but largely functional dystrophin protein.”

Kyndrisa is targeted to treat DMD patients who suffer from the deletion of exon 50. By the method of exon-skipping, the drug masks exon 51, resulting in production of the dystrophin protein.

The FDA advisory committee has given an unfavorable opinion to Kyndrisa. But most analysts estimate the probability of FDA approval for the drug to be about 50%. If approved, the drug will substantially add to BioMarin Pharmaceutical’s revenues, making it a strong competitor to peer biotechnology companies such as Amgen (AMGN), Celgene (CELG), and Gilead Sciences (GILD).

Investors can participate in the upside potential of Kyndrisa and still avoid excessive company-specific risks by investing in the Vanguard Extended Market ETF (VXF). BioMarin Pharmaceutical accounts for about 0.39% of VXF’s total holdings.