Why Have Newmont and Agnico Outperformed?

In this series, we’ll look at various factors that are affecting gold miners like Barrick Gold, Newmont Mining, Goldcorp, Yamana Gold, Agnico Eagle Mines, and Kinross Gold.

Dec. 24 2015, Updated 4:14 p.m. ET

Gold price performance

After getting a good start to the year—driven by strong demand from Asia, the Greek crisis, and the Swiss currency cap removal—gold prices started pulling back in April. Global uncertainty started receding and major economies faced weak inflation. Since then, the Fed rate hike decision has been the single most dominant factor affecting gold prices. More recently, the Fed rate hike decision impacted gold prices somewhat negatively, but they were supported on an accommodative policy outlook.

Agnico and Newmont outperform

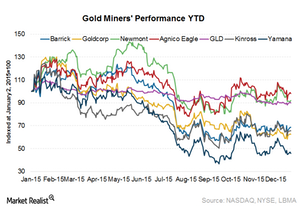

Gold stocks are also in for a roller coaster ride along with gold prices. Because of gold miners’ operating leverage, their stock prices usually fall faster when gold prices are falling. This works the other way too. While gold prices (GLD) have fallen by 10% year-to-date, the VanEck Vectors Gold Miners Index (GDX) has fallen 28%. The fall in GDX was led by senior gold miners including Barrick Gold (ABX), Goldcorp (GG), Kinross Gold (KGC), and Yamana Gold (AUY). They fell 32%, 37%, 34%, and 54%, respectively. Newmont Mining (NEM) and Agnico Eagle (AEM) have outperformed the gold sector with smaller negative returns of -7% and -2%, respectively.

While the market is happy with Newmont’s better-than-expected cost cutting and debt reduction efforts, the market has rewarded Agnico’s potential exploration upside and operational consistency.

Series overview

In this series, we’ll look at various factors that are affecting gold miners like Barrick Gold, Newmont Mining, Goldcorp, Yamana Gold, Agnico Eagle Mines, and Kinross Gold. Goldcorp forms the largest share of GDX’s holdings at 7.20%.

We’ll discuss factors like cost profile, cost reduction progression among miners, reserves profile, and debt standing. Finally, we’ll see how they boil down to stock performance under the current gold price environment. We’ll see which stocks are more levered to gold prices.

We’ll start by looking at gold miners’ geographical exposure in the next part of this series.