As Good as Gold: Analyzing Gold Miners’ Production Growth

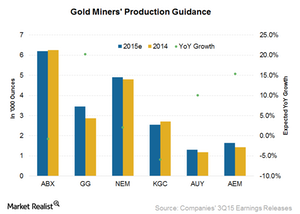

In 3Q15, Goldcorp (GG) posted record gold production of 922,200 ounces—2% growth quarter-over-quarter and 42% growth year-over-year.

Nov. 20 2020, Updated 11:53 a.m. ET

Upside to guidance?

In 3Q15, Goldcorp (GG) posted record gold production of 922,200 ounces—2% growth quarter-over-quarter and 42% growth year-over-year. Goldcorp expects production for 2015 to be at the higher end of 3.3 million–3.6 million ounces. This outlook is due to anticipated higher production at some of its mines, including Penasquito and Cerro Negro.

Agnico Eagle Mines’ (AEM) 3Q15 gold production beat market expectations. AEM has also raised its production guidance for 2015 to 1.65 million ounces from 1.6 million ounces. Agnico has exceeded its guidance for a few years in a row. This year’s guidance also seems conservative and could have an upside.

Kinross Gold’s (KGC) 3Q15 production was slightly higher than market expectations. It maintained its annual guidance of 2.5 million–2.6 million ounces of gold production. Kinross’s midpoint of production guidance for 2015 implies a conservative guidance for 4Q15, given the company’s production for the first nine months of the year.

Possible downside?

Yamana Gold (AUY) had missed its guidance. In its 3Q15 results, it reiterated its full-year guidance to 1.3 million ounces. However, the company might fall short of its guidance. Some of its mines, including Jacobina, El Penon, and Mercedes, are tracking below their mid-point guidance range. Production in 4Q15 will have to improve 15% quarter-over-quarter to reach production guidance.

Barrick Gold (ABX) beat production estimates with 1.66 million ounces of gold production in 3Q15. The company also tightened its gold production guidance range from 6.1 million–6.4 million ounces to 6.1 million–6.3 million ounces. This mainly reflects lower anticipated gold production from Acacia Mining. The company expects a stable to declining production profile post-2017 due to asset sales and lack of a strong pipeline to replace existing production.

Newmont Mining’s (NEM) gold production was 1,340 thousand ounces in 3Q15—16% higher year-over-year. This is also Newmont’s highest output for the past seven quarters. While Newmont divested some of its assets during the year, its acquisition of CC&V (Cripple Creek and Victor) mine from AngloGold Ashanti (AU) helped the company offset nearly two-thirds of that decline. Newmont maintained its annual guidance at 4.7 million–5.1 million ounces.

Overall, given conservative guidance, Agnico and Kinross could deliver an upside over guidance while Yamana could underwhelm with its fiscal 2015 production. Agnico and Kinross form 8.8% of the VanEck Vectors Gold Miners ETF (GDX).

In the next part of this series, we’ll see which gold miners can replace their reserves and further increase their production in the long term.