Amgen’s Nephrology Drugs Expect Falling Revenue in 4Q15

Analysts projected a fall in the revenue for Amgen’s nephrology drugs, Aranesp and Epogen, in 4Q15. The drugs are expected to suffer in the coming quarters.

Nov. 20 2020, Updated 4:23 p.m. ET

Falling revenue

Wall Street analysts projected a gradual fall in the revenue for Amgen’s nephrology drugs, Aranesp and Epogen, in 4Q15. Amgen’s nephrology drugs are expected to suffer in the coming quarters due to rising competition.

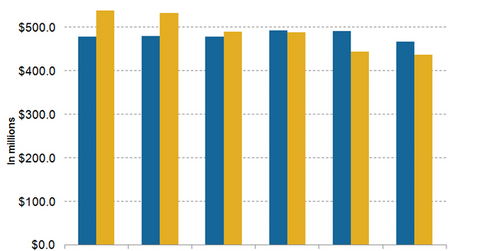

The above chart shows that in 4Q15, the revenue from Aranesp is expected to reach about $492.0 million. This is a YoY (year-over-year) rise of 2.7% compared to the drug’s sales in fiscal 4Q14. However, Epogen’s sales are expected to witness a significant YoY fall of ~17.6%. Its sales are expected to reach $444.2 million in 4Q15.

Nephrology drugs

Amgen’s (AMGN) portfolio of nephrology drugs consists of ESAs (Erythropoietin Stimulating Agents) Aranesp and Epogen. Both Epogen and Aranesp treat anaemia—a condition marked by low red blood cells. Epogen is administered to patients suffering from chronic kidney disease and undergoing dialysis. Aranesp is specifically targeted for patients on dialysis. Cleveland Clinic explains the role of erythropoietin as “Red blood cells are produced in the bone marrow (the spongy tissue inside the bone). In order to make red blood cells, the body maintains an adequate supply of erythropoietin (EPO), a hormone that is produced by the kidney.” Cleveland Clinic also explains that ESAs are given to patients suffering from chronic or end-stage kidney diseases. Their bodies aren’t able to produce sufficient erythropoietin. This results in reduced red blood cell levels. To know more about Amgen’s nephrology drugs, read Amgen’s Presence in Inflammation, Nephrology, and Bone Segments.

Epogen sales

In 2011, Amgen entered into agreements with dialysis chains DaVita HealthCare and Fresenius Medical Care Center. Together, these chains treat about two-thirds of the dialysis patients in the US. According to the agreement, it’s obligatory for DaVita HealthCare to purchase at least 90% of its ESA drug supply from Amgen until 2018. However, Fresenius Medical Care Center entered into a non-exclusive agreement with Amgen that ended in 2014.

In fiscal 3Q15, Fresenius started using another ESA drug, Roche’s (RHHBY) Mircera, for about half of the dialysis patients who were originally treated with Epogen. The shift resulted in a YoY fall in Epogen’s revenue by about 6% from $518 million in fiscal 3Q14 to $489 million in fiscal 3Q15.

With Roche entering into an exclusive licensing agreement with Galenica for the commercialization of Mircera and Galenica contracting with Fresenius Medical Care North America for supplying Mircera, it’s expected that more of Fresenius’s patients will be treated with Mircera instead of Epogen.

The negative revenue impact for Epogen would have been greater if the FDA approved the biosimilar version of the drug called “Retacrit.” On October 16, 2015, the FDA issued a complete response letter to Pfizer (PFE). It rejected its application for the approval of Retacrit. Pfizer plans to resubmit the application to the FDA in 1H16.

Aranesp sales

In fiscal 3Q15, ~50,000 of the total 400,000 dialysis patients in the US used Aranesp. This included 20,000 patients from Fresenius Medical Care Center. Aranesp faces tough competition from other anemia drugs like Johnson & Johnson’s (JNJ) Procrit through subsidiary Janssen Pharmaceuticals and biosimilar drugs from Teva Pharmaceuticals.

Instead of directly investing in Amgen and being exposed to excessive company specific risks, investors can invest in the SPDR S&P 500 ETF (SPY). Amgen accounts for 0.7% of SPY’s total holdings.