Analyzing Tiffany’s Largest Segment: The Americas

Tiffany & Co.’s Americas segment includes sales from company-operated retail stores in the United States, Canada, Mexico, and Brazil.

Nov. 20 2020, Updated 12:46 p.m. ET

Americas segment

Tiffany & Co. (TIF) operates in many countries, with 295 company-operated stores. Its Americas segment includes sales from company-operated retail stores in the United States, Canada, Mexico, and Brazil. It also includes sales in these markets through business-to-business, internet, catalog, and wholesale operations.

Americas business

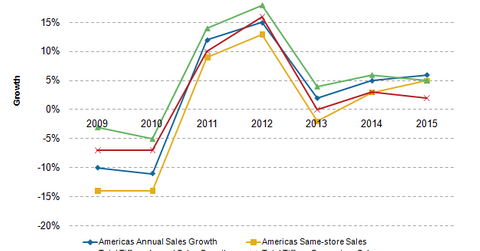

At the end of fiscal 2015, ended January 31, 2015, Tiffany operated 122 retail stores in the Americas: 95 in the United States, 11 in Canada, 11 in Mexico, and five in Brazil. This included 12 company-operated stores within department stores in Canada and Mexico. At the end of fiscal 2015, the Americas segment had a total gross retail square footage of 710,000.

Revenue contribution

Tiffany’s Americas segment accounted for 48% of the company’s total revenue in fiscal 2013, 2014, and 2015, while sales in the United States accounted for 88%, 88%, and 89% of revenue in the Americas in the respective periods. This revenue is further divided into the following categories:

- Statement, fine, and solitaire jewelry – items containing diamonds and gemstones, contributing 23% of sales in the Americas

- Engagement jewelry and wedding bands – items containing diamonds, contributing 23% of sales in the Americas

- Fashion jewelry – non-gemstone, sterling silver, gold, and metal items, accounting for 44% of sales in the Americas, with sterling silver contributing more than 50% of total fashion jewelry sales

Earnings from operations for the Americas segment represented 21.4%, 19.4%, and 18.8% of the company’s net Americas sales for fiscal 2013, 2014, and 2015, respectively.

Peer group comparison

Tiffany’s major peer in the jewelry industry (XRT), Signet Jewelers (SIG), has presence mainly in the United States, which represented 86.8% of its total revenue in fiscal 2015. However, Tiffany’s peer Fossil (FOSL) has a presence in the United States, the Asia-Pacific region, Japan, Europe, and other countries.

Tiffany, Signet, and Fossil all have exposure in the iShares Russell 1000 Growth ETF (IWF) as well as in the iShares Core S&P 500 ETF (IVV). Together, these three companies compose 0.19% of the holdings of IVV. IVV measures the performance of the large-cap (large capitalization) sector of the US equities market, tracking the top 500 stocks.