Jobs Report: Why It’s the Highlight of the Week

There isn’t much real estate–related economic data this week. There are some important macro reports as well as the jobs report on Friday.

Aug. 18 2020, Updated 5:35 a.m. ET

Highlight of the week

There isn’t much real estate–related economic data this week, aside from construction spending on Monday. There are some important macro reports between personal income and personal spending as well as the jobs report on Friday. Since the FOMC (Federal Open Market Committee) statement didn’t really set up markets for an imminent rate hike, Friday’s jobs report will have somewhat lower significance.

On the earnings front, there will be a lot of mortgage REITs reporting this week—Annaly Capital, PennyMac, Redwood Trust, and Two Harbors.

Economic data this week

Below is a summary of this week’s economic data.

Monday, August 1:

- ISM Manufacturing Index

- Construction spending

Tuesday, August 2:

- personal income

- personal spending

Wednesday, August 3:

- Mortgage Bankers Association mortgage applications

- ADP Employment change

- ISM Non-Manufacturing Index

Thursday, August 4:

- initial jobless claims

- Bloomberg Consumer Comfort Index

- factory orders

- Challenger job cuts

Friday, August 5:

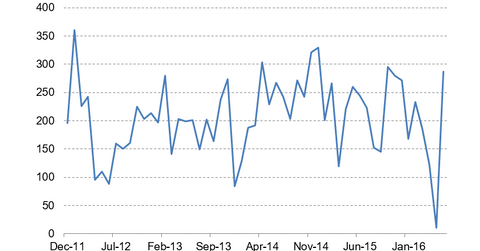

- unemployment rate

- non-farm payrolls

- average weekly hours

- average weekly earnings

- labor force participation rate

Earnings this week:

Implications for mortgage REITs

REITs such as Annaly Capital Management and American Capital Agency (AGNC) will likely focus on data that will move the bond market. That means REIT investors will focus primarily on the jobs report on Friday. Investors who want to bet on interest rates can look at the iShares 20+ Year Treasury Bond ETF (TLT).

Impact on homebuilders

Homebuilders such as PulteGroup (PHM) and CalAtlantic Group (CAA) will pay the most attention to construction spending and the jobs report. Investors can get access to the homebuilding sector through the SPDR S&P Homebuilders ETF (XHB).

In the next part of this series, we’ll discuss what happened last week.