Nationstar Mortgage Holdings Inc

Latest Nationstar Mortgage Holdings Inc News and Updates

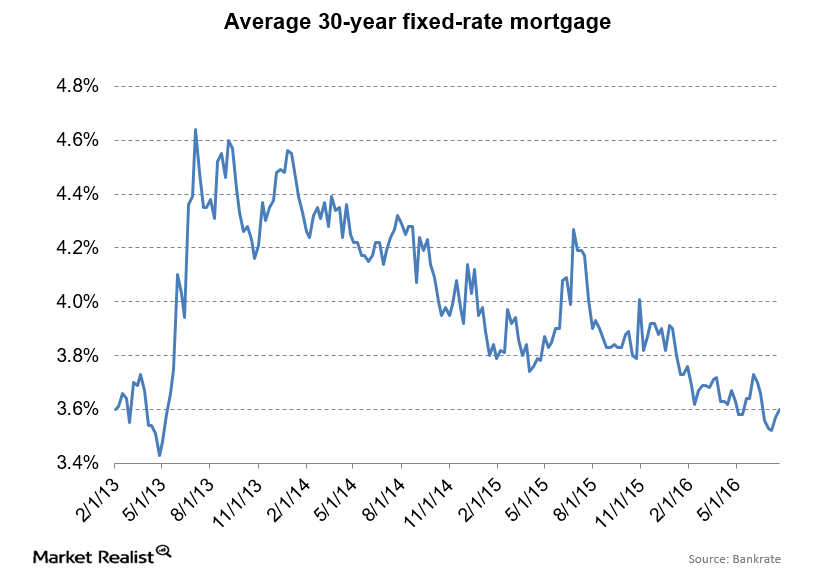

Mortgage servicing rights increase in value as interest rates rise

Mortgage servicing rights are one of the few financial assets that increase in value as rates rise Most mortgage REITs are exposed to changes in interest rates, and are usually long-duration, which means that the value of their portfolio decreases in value as interest rates rise. Good examples of these types of REITs would be […]

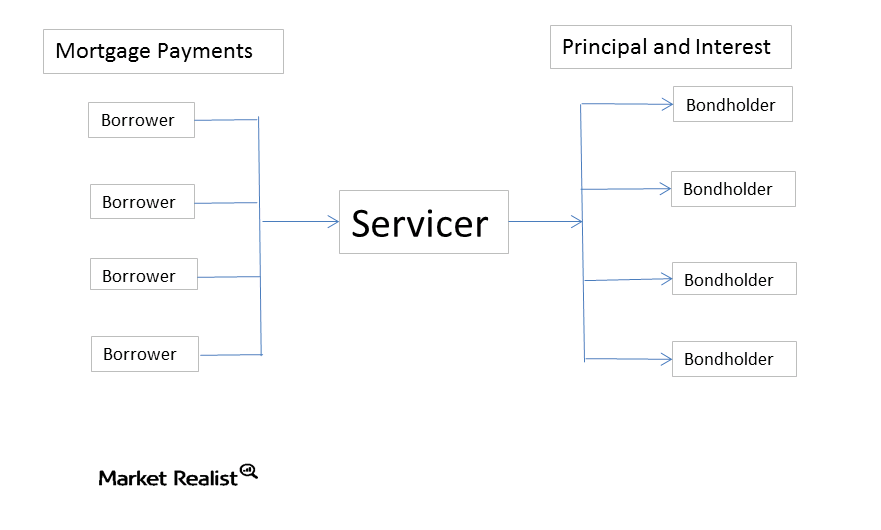

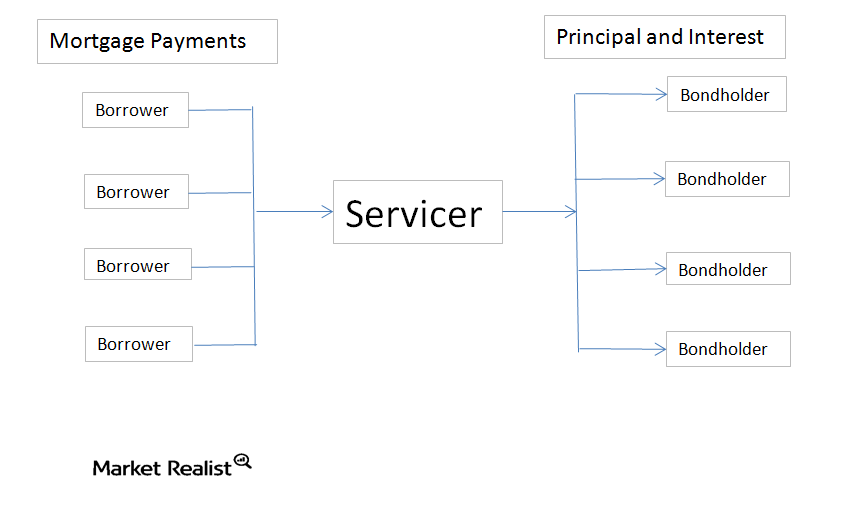

Why mortgage servicing rights imply risks for servicers

Risks of being a servicer Generally, servicing seems like an easy job. Collect the payment, give the government its take, pass the (smaller) payment to the bondholders, and keep the rest. What could go wrong? There’s just one catch. What happens if you miss your mortgage payment? The U.S. government guarantees Ginnie Mae securities. When […]

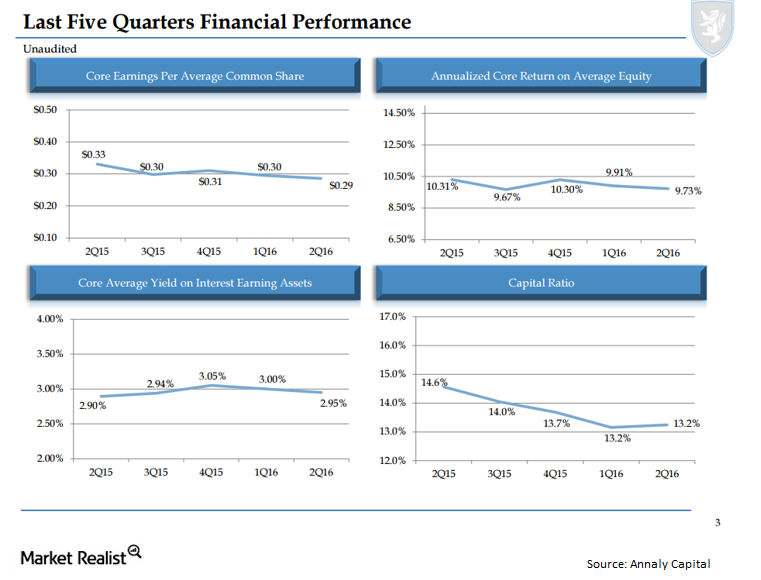

What’s Annaly Capital’s Take on the Bond Market’s Volatility?

Annaly positioned itself to reduce its interest rate risk and increase its credit risk. Since 2009, global bond markets have risen in value by about $17 trillion.

Mortgage Rates Rise with the Bond Market

Lately, mortgage rates and bond yields have shown a weak correlation. Treasury yields have fallen over the past month, while mortgage rates have been steady.