PennyMac Mortgage Investment Trust

Latest PennyMac Mortgage Investment Trust News and Updates

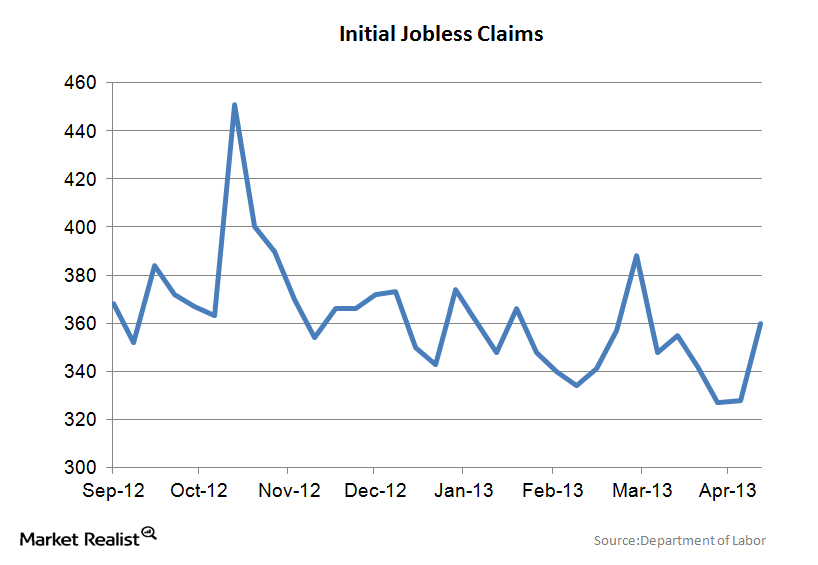

Initial jobless claims jump

Initial jobless claims rose to an annualized rate of 360,000 for the week ended May 10th Initial jobless claims are one of the few labor market indicators that are released every week. Unemployment is a profound driver of economic growth, and persistent unemployment has been the Achille’s heel of this recovery. While it seems like […]

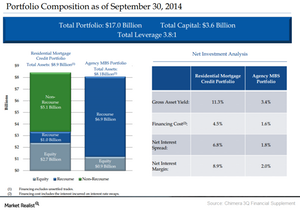

Chimera posts growth in third quarter profit and interest income

Chimera’s core earnings grew to $116 million compared to $93 million in the year-ago period. Growth was mainly due to an increase in net interest income.

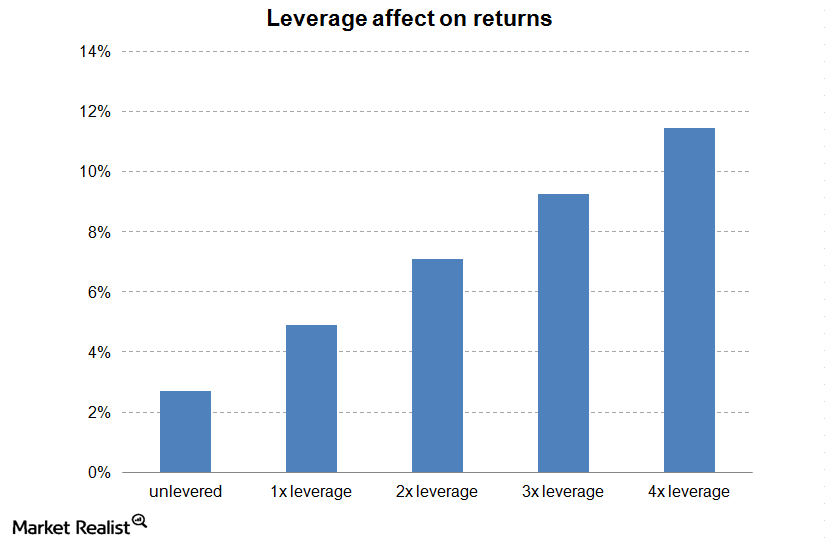

Leverage and mortgage REITs – Part 2

Leverage and Mortgage REITs – Part 1 How a mortgage REIT typically does it Most mortgage REITs use repurchase agreements to fund their balance sheet. A repurchase agreement (repo) is basically a secured loan. The REIT will pledge the mortgage backed securities they just bought as collateral for a loan. It is actually an agreement […]

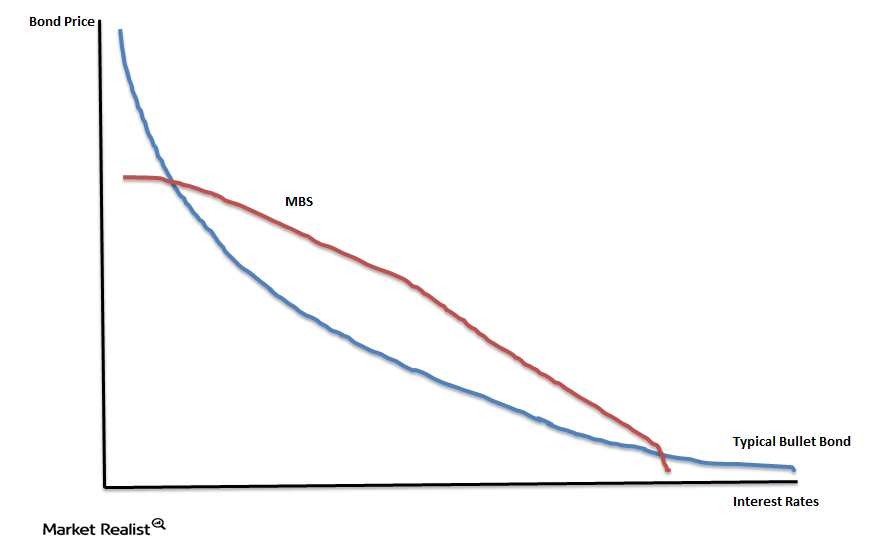

Primer on mortgage backed securities, Part 5

Continued from Primer on mortgage backed securities, Part 4. Prepayment risk Prepayment risk and interest rate risk go hand-in-hand. The main difference between a mortgage backed security and a government bond is that with a government bond, you know exactly when you will get your principal and interest payments. If you purchase a 7-year Treasury […]

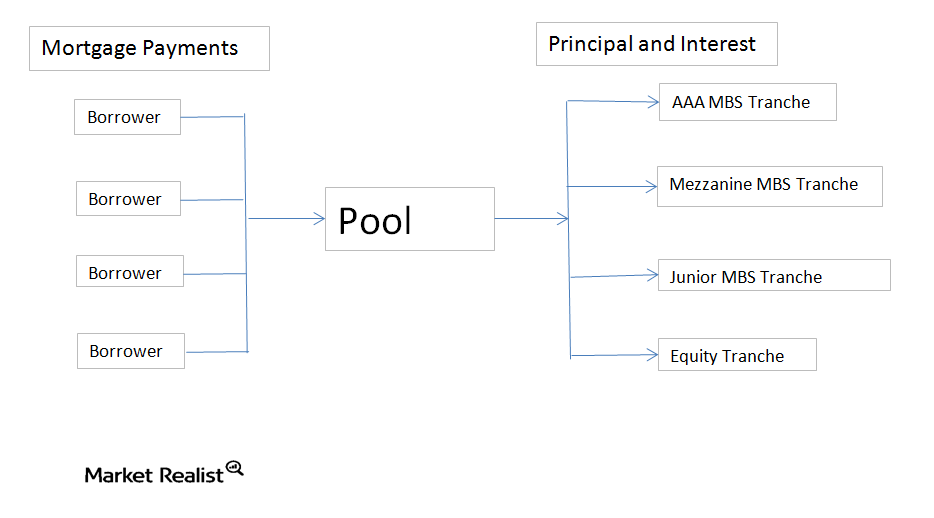

Primer on mortgage backed securities, Part 1

What are mortgage backed securities? Mortgage backed securities are pools of individual mortgages that have similar characteristics. They allow a relatively illiquid asset (an individual home mortgage) to be converted into a very liquid asset that can be traded with relative ease. They also allow an issuer to divide up the cash flows in order […]

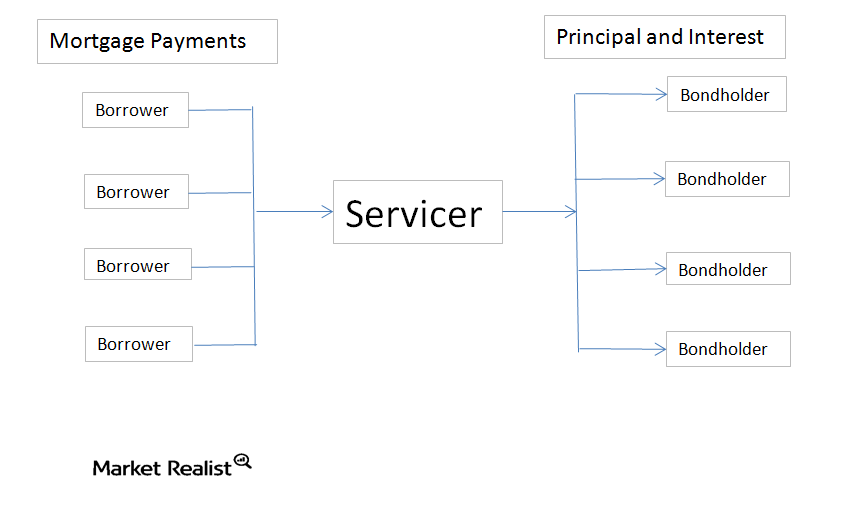

Why mortgage servicing rights imply risks for servicers

Risks of being a servicer Generally, servicing seems like an easy job. Collect the payment, give the government its take, pass the (smaller) payment to the bondholders, and keep the rest. What could go wrong? There’s just one catch. What happens if you miss your mortgage payment? The U.S. government guarantees Ginnie Mae securities. When […]

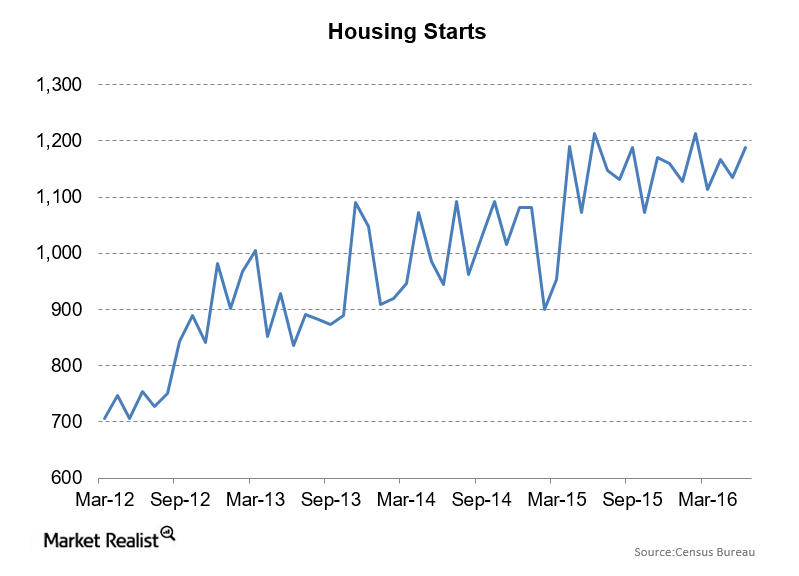

Why Do Housing Starts Remain Muted?

Housing starts and building permits came in around 1.2 million—towards the top end of a narrow range over the past year.

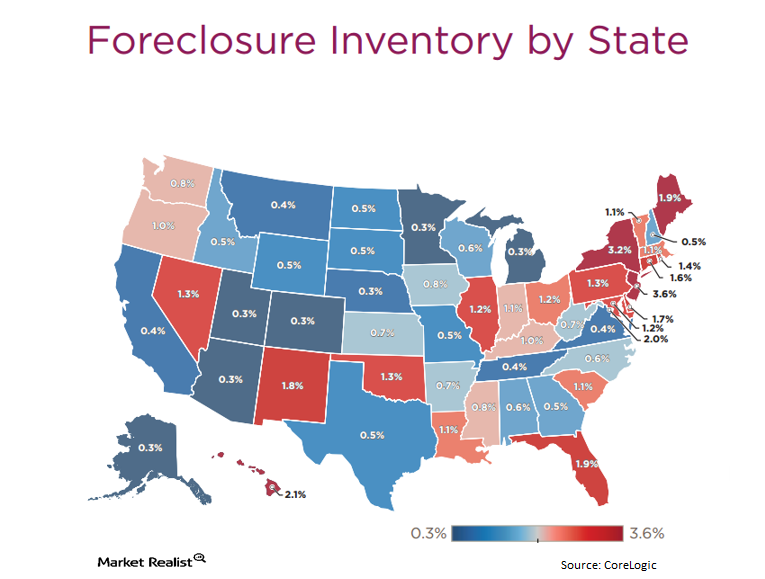

Why Are State Foreclosure Laws Important?

There are two basic types of state foreclosure laws—judicial and non-judicial. In non-judicial states, foreclosures are handled through a streamlined process.