Spirit Airlines: An Introduction to a Low-Cost Pioneer

Spirit Airlines (SAVE) is headquartered in Miramar, Florida. It’s a pioneer of ultra-low-cost carrier or ULCC airlines.

Nov. 20 2020, Updated 1:23 p.m. ET

Introduction to Spirit Airlines

Spirit Airlines (SAVE) is headquartered in Miramar, Florida. It’s a pioneer of ultra-low-cost carrier or ULCC airlines. The company was founded in 1964 as Clipper Trucking Company in Michigan and later moved to air charter operations in 1990, rebranding itself as Spirit Airlines. The airbus-only fleet of Spirit Airlines provides services to over 57 airports in the United States, the Caribbean, and Latin America with over 350 daily flights.

The $3.7 billion–market cap company provides customers lower base fares with a range of optional services. By unbundling the services, it allows customers to pay for only services that they need. According to Spirit Airlines, it targets price-conscious customers who pay for their own travel by competing with its total price.

Who does Spirit compete with?

Spirit’s (SAVE) competitors include American Airlines (AAL), United Airlines, and Delta Airlines (DAL). American Airlines operates in more than 50% of the markets that Spirit serves by the company, making it a principal competitor. Spirit also competes with budget carriers such as JetBlue (JBLU) and Southwest Airlines (LUV). Its ULCC model is also followed by Frontier Airlines and Allegiant Travel Company (ALGT).

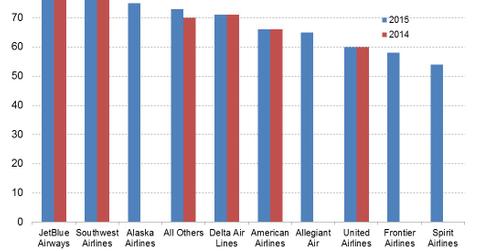

Consumer satisfaction survey

Spirit Airlines, one of the fastest-growing airlines, is also among the most profitable airlines in the United States. According to a 2015 American Customer Satisfaction Index Travel report, Spirit ranked tenth among US airlines. This is an improvement in its ratings, as it didn’t figure among the top ten companies until 2015. The company’s efforts, such as “Free Spirit Miles” for customers who felt wronged by the airline, seem to be paying off. JetBlue (JBLU) continued to lead the survey with a score of 81, followed by Southwest (LUV) and Alaska Air Group (ALK), scoring 78 and 75, respectively.

Investors can gain exposure to the airlines industry through the iShares Dow Jones Transportation Average ETF (IYT), U.S. Global Jets ETF (JETS) and the SPDR S&P Transportation ETF (XTN).