Analyzing Rowan’s Rig Scrapping and Stacking Activity in 3Q15

Offshore drilling (XLE) (IYE) is a capital-intensive industry requiring a large amount of money to keep rigs active and well-maintained.

Dec. 4 2020, Updated 10:53 a.m. ET

Cold stacking and scrapping

Offshore drilling (XLE) (IYE) is a capital-intensive industry requiring a large amount of money to keep rigs active and well-maintained. All players in the industry including Rowan Companies (RDC), Diamond Offshore (DO), Ensco (ESV), Seadrill (SDRL), Transocean (RIG), Atwood Oceanics (ATW), and Noble (NE) are reacting to the current depressed rig demand scenario by scrapping rigs or cold-stacking them in order to reduce costs.

Warm stacking and cold stacking

The company cold-stacked two rigs in 3Q15 and now has a total three cold-stacked rigs as of October 2015. Cold-stacking rigs reduces a company’s operating costs, but it also hampers the company’s revenue potential. Cold-stacked rigs can be brought back into the active fleet once market conditions improve, but reactivating rigs is very expensive.

The company currently has four warm-stacked high specification jack-ups. The company is actively marketing these rigs and doesn’t have immediate plans to cold-stack these rigs. The company mentioned in its conference call that it may decide to relocate one or more of these rigs for contracting opportunities in other markets. The company is hopeful it will secure new contracts for these rigs in 2016.

Also, contracts on four rigs will expire in 4Q15. We may see these rigs warm-stacked or cold-stacked in the absence of new contracts or extensions.

Rowan’s fleet age profile

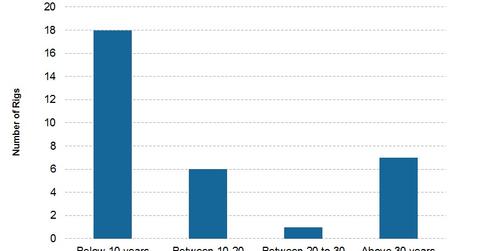

Rowan Companies has an average fleet age of 12.8 years. 18 rigs out of its total fleet of 32 are considered young at less than ten years of age. Six of Rowan’s rigs are between ten and 20 years old, one is between 20 and 30 years old, and seven rigs are older than 30 years old.

Possibilities for scrapping

Seven of Rowan’s rigs are more than 30 years old. Out of these seven rigs, four have contracts extending beyond the second half of 2016 and three rigs are idle.

Looking at Rowan’s fleet age, three of these rigs are potential scrapping candidates. When a company chooses to scrap rigs, it reduces its costs, but it also reduces its fleet size and thus its earning potential.