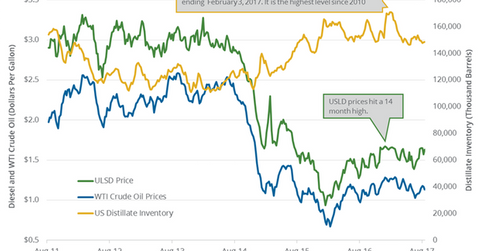

US Distillate Inventories Were Flat Last Week

The EIA (U.S. Energy Information Administration) estimates that US distillate inventories were flat at 148.4 MMbbls (million barrels) between August 11, 2017, and August 18, 2017.

Aug. 24 2017, Updated 2:36 p.m. ET

US distillate inventories

The EIA (U.S. Energy Information Administration) estimates that US distillate inventories were flat at 148.4 MMbbls (million barrels) between August 11, 2017, and August 18, 2017. Inventories fell by 4.9 MMbbls or 3.2% year-over-year. US diesel futures rose 2.1% to $1.62 per gallon on August 23, 2017. Likewise, US crude oil (USO) (UCO) (VDE) futures also rose on August 23, 2017.

Higher diesel and crude oil prices have a positive impact on the earnings of refiners and producers’ earnings like Western Refining (WNR), Marathon Petroleum (MPC), Stone Energy (SGY), and Triangle Petroleum (TPLM).

US distillate production, imports, and demand

US distillate production fell by 196,000 bpd (barrels per day) to 5.1 MMbpd (million barrels per day) between August 11, 2017, and August 18, 2017. Production fell 3.7% week-over-week but rose 242,000 bpd or 5% year-over-year.

US distillate imports fell by 35,000 bpd to 132,000 bpd between August 11, 2017, and August 18, 2017. Imports fell 21% week-over-week and 92,000 bpd, or 41%, year-over-year.

US distillate demand fell by 145,000 bpd to 4.1 MMbpd between August 11, 2017, and August 18, 2017. Demand fell 3.4% week-over-week but rose 287,000 bpd or 7.5% year-over-year.

Impact

US distillate inventories are down ~3% in the last ten weeks. They are also below the five-year range. A fall in distillate inventories could help diesel and crude oil (PXI) (USL) prices.

Read Hedge Funds Reduce Bullish Bets on US Crude Oil for 2nd Straight Week for more information on crude oil price forecasts.

Read How India’s Crude Oil Imports, Production, and Demand Impact Prices and US Refinery Demand Outage and Supplies Impact Crude Oil Futures to learn more.

Read Will US Natural Gas Futures Fall in 3Q17? for more on natural gas.