The Lam Research-KLA-Tencor Merger—Semiconductor Consolidation

On Wednesday, October 21, Lam Research announced its merger with KLA-Tencor in yet another big deal in the semiconductor space.

Oct. 22 2015, Published 9:02 a.m. ET

Merger arbitrage

To perform merger arbitrage, an investor generally buys the stock of the company being acquired, short-sells the relevant ratio of the acquirer’s stock, if applicable, and waits for the deal to close. When the merger is complete, the investor exchanges the stock of the company being acquired for the amount agreed upon in the deal.

Another big deal in the semiconductor space

On Wednesday, October 21, Lam Research (LRCX) announced its merger with KLA-Tencor (KLAC) in yet another big deal in the semiconductor space. On the same day, Western Digital (WDC) agreed to buy SanDisk (SNDK). Rising costs and the maturation of the market for personal computers and smartphones are putting pressure on semiconductor manufacturers to merge in order to cut costs. The customers for these companies are also merging, which leads to another catalyst for mergers—the opportunity to enhance negotiating power with bigger customers.

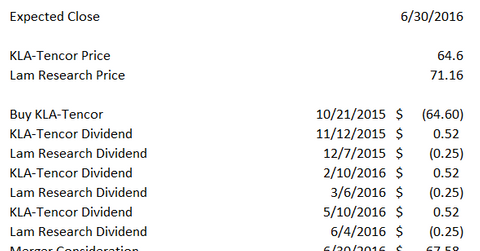

Basics of the arbitrage spread

The Lam Research-KLA-Tencor merger is subject to customary closing conditions and regulatory approvals. According to the press release, the deal is expected to close in the first half of 2016. If you assume a closing date of June 30, 2016, then the spread is trading at an annualized rate of 8.6%. This is a somewhat narrow arbitrage spread given that antitrust regulators have been taking a more aggressive stance toward mergers in this sector. The proposed merger between Applied Materials (AMAT) and Tokyo Electron fell apart earlier this year after stiff resistance from the U.S. Department of Justice.

Market reaction

The stocks of both KLA-Tencor and Lam Research rose on the news. Analysts generally praised the commercial logic of the transaction. The arbitrage spread is somewhat narrow given the potential antitrust concerns.

Merger arbitrage resources

Other important merger spreads include the deal between Baker Hughes (BHI) and Halliburton (HAL) and the merger between Freescale Semiconductor (FSL) and NXP Semiconductors (NXPI). For a primer on risk arbitrage investing, read “Merger Arbitrage Must-Knows: A Key Guide for Investors.”

Investors who are interested in trading in the tech sector can look at the iShares Global Technology ETF (IXN).