SanDisk Corp

Latest SanDisk Corp News and Updates

JAT Capital Eliminates Exposure to SanDisk Corporation

JAT Capital sold its position in SanDisk Corporation (SNDK) in 4Q14. The position had represented 1.2% of the fund’s third-quarter portfolio.

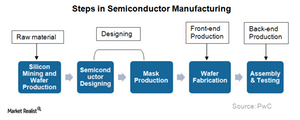

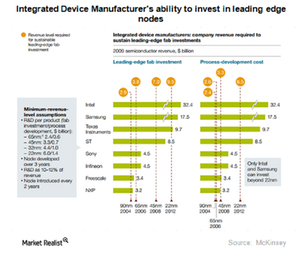

What Makes Micron a Key Player in Semiconductor Manufacturing?

Semiconductor manufacturing is complex and involves design, fabrication, assembly, and testing. Building a fab requires investments of $3–4 billion.

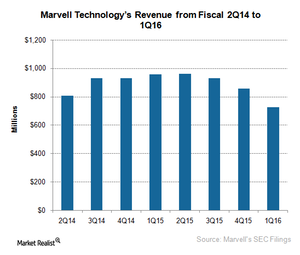

What’s the Root Cause of Marvell’s Problems?

Let’s dig into the cause of Marvell’s accounting issues, see how one thing led to another, and look at how its new management plans to untangle the chaos.

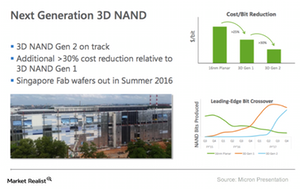

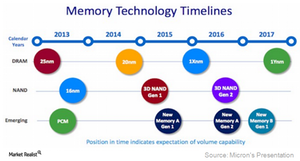

What the Investments of Micron and Other Suppliers in 3D NAND Capacity Could Mean

Micron is moving a step further and developing 3D NAND Generation 2 technology. It expects to bring this into production in fiscal 2Q17.

Alken Says $19 Billion Price for SanDisk Is Too High

Alken stated that in light of changing market dynamics and the capital market scenario, the $19 billion price for SanDisk, which has been posting declining earnings in fiscal 2015, is too high.

Micron’s Technology Roadmap for 2016 and 2017

Micron’s technology transition will slow down the output and revenue in the short term. The company will be able to meet advanced memory products’ needs.

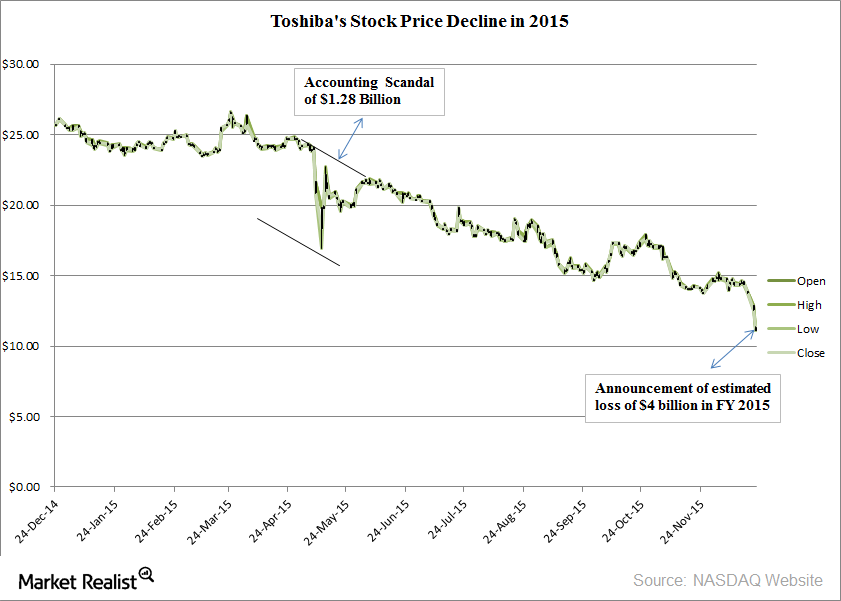

Toshiba to Implement Measures to Prevent Recurrence of Fraud

Toshiba is looking to start an evaluation system for the CEO and president of the company, in which 120 senior managers will hold a vote of confidence in January 2016.

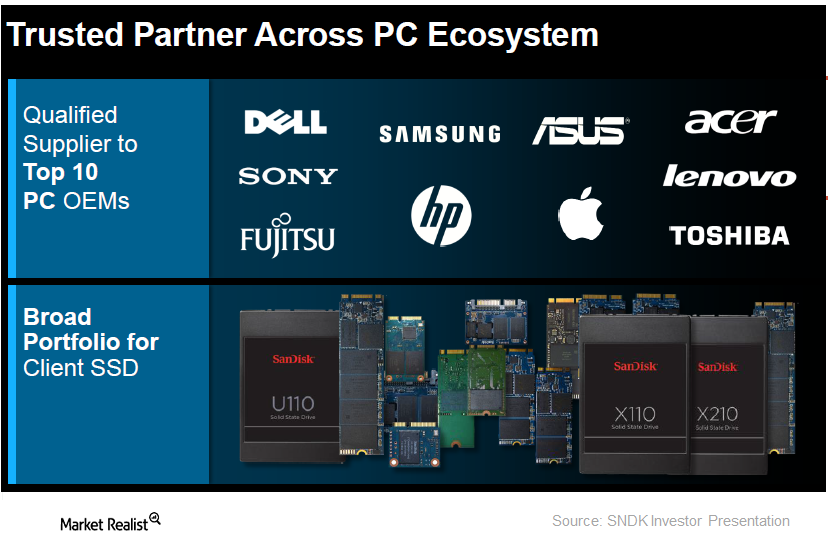

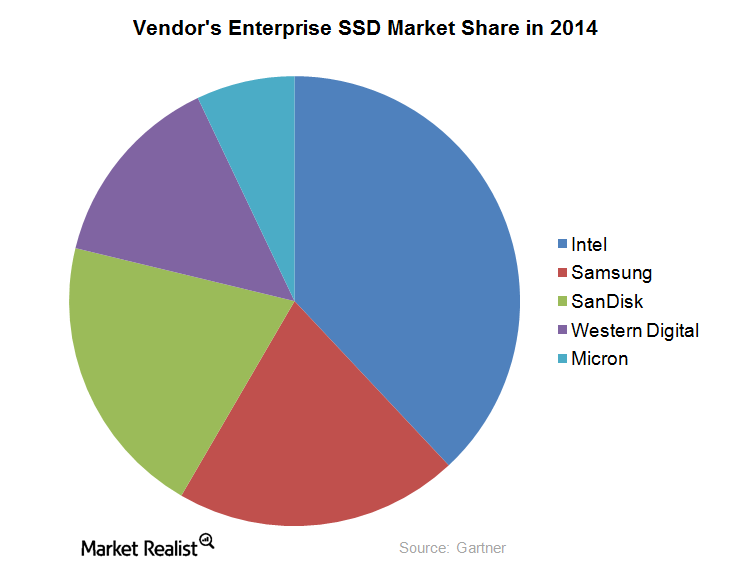

With SanDisk Purchase, Western Digital Will Pass Samsung in SSD

With the action on the acquisition front, including the SanDisk acquisition, Western Digital is geared up to increase and enhance its presence in the SSD arena.

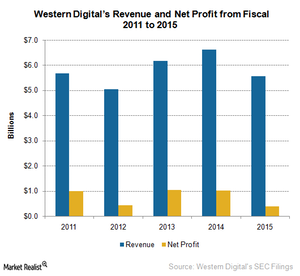

Why Western Digital May Want to Acquire SanDisk

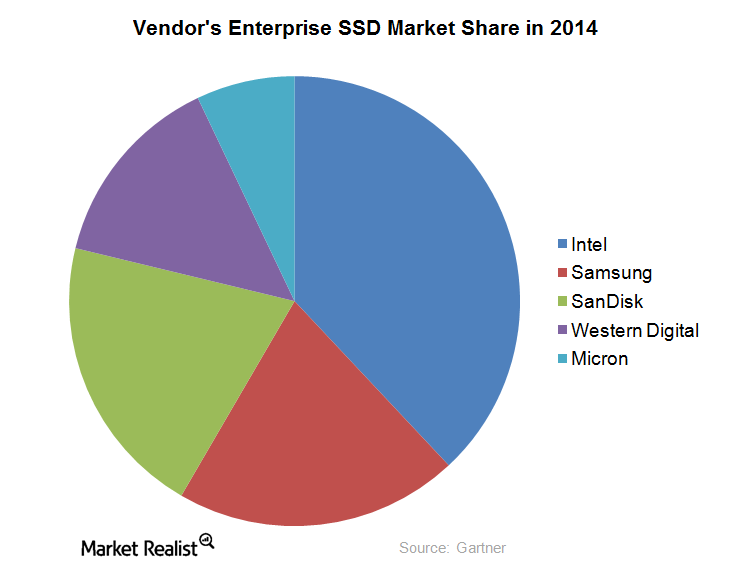

Western Digital (WDC) and Micron (MU) held 10.2% and 5.1% of the market share, respectively, in the enterprise SSD space.

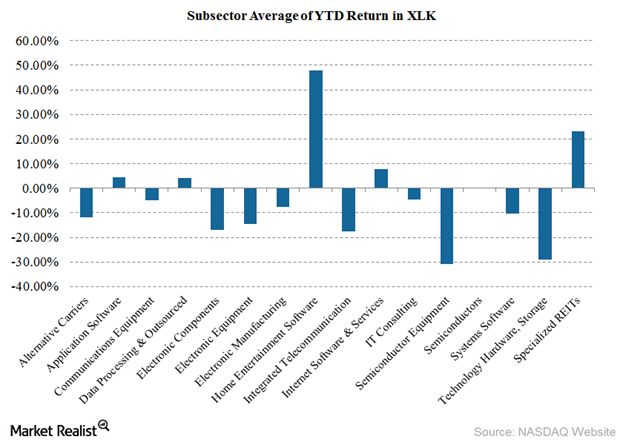

Macroeconomic Factors Affecting Technology Stock Performance in 2015

Macroeconomic factors like the Greek debt crisis, the declining Chinese stock market, and global growth issues have made tech stocks not so attractive.

Macroeconomic Factors Affecting Technology Stocks in 2015

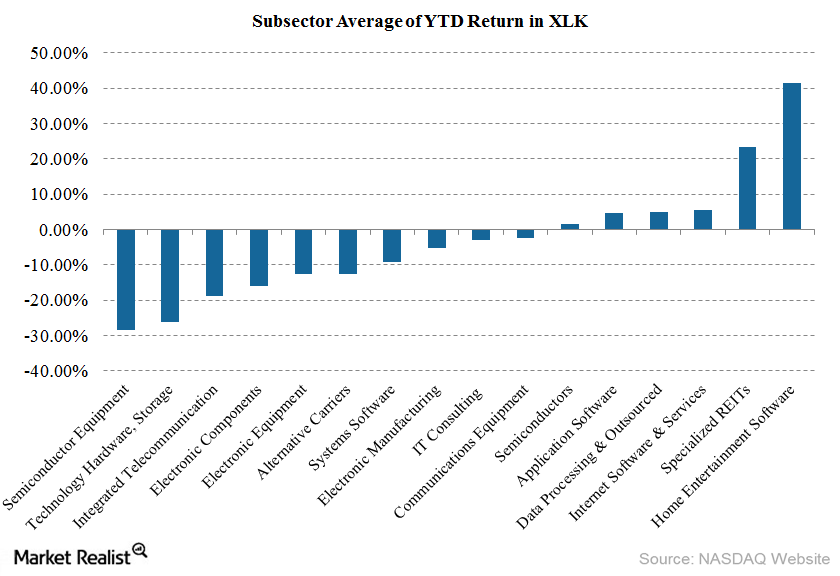

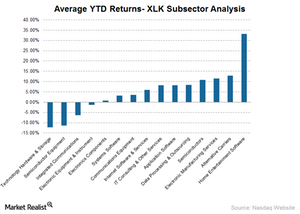

In this series, we’ll analyze the YTD performance of firms in the Technology, Hardware, and Storage subsector and that are a part of the Technology Select Sector SPDR ETF (XLK).

South Korea: Second Largest Global Semiconductor Manufacturer

After memory chips, LEDs comprise the second most produced semiconductor products in South Korea. The country accounts for ~13% of the global LED market.

Analyzing the Subsectors in the Technology Select Sector ETF

The Technology Hardware & Storage subsector underperformed the most since the beginning of January 2015. The stocks have primarily generated negative returns.