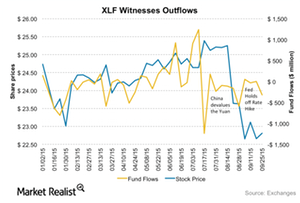

Fund Flows to XLF Have Been Declining

Exchange-traded fund investors added almost $552.6 million on average to the Financial Select Sector SPDR ETF (XLF) in the last quarter. During the week ending September 25, the ETF witnessed outflows of $318.3 million.

Dec. 4 2020, Updated 10:52 a.m. ET

Fund flows

Exchange-traded fund investors added almost $552.6 million on average to the Financial Select Sector SPDR ETF (XLF) in the last quarter. In the last month, investors have withdrawn $290.4 million from the XLF ETF. During the week ending September 25, the ETF witnessed outflows of $318.3 million.

Shares of XLF have generated negative returns of 7.76% YTD (year-to-date) despite increased optimism in the US financial sector. Much of this lackluster performance is attributable to the delay in a rate liftoff by the Federal Reserve and concerns of a global growth slowdown triggered by China devaluing its currency.

Institutional investors liquidate exposure to XLF in 2Q15

13F filings of major institutional asset managers for the second quarter of 2015 give a mixed picture for the Financial Select Sector SPDR ETF (XLF). In 2Q15, trade activity by 13F filers displays a 3.87% reduction in aggregate shares held by institutional investors and hedge funds. Among the 594 13F filers holding the stock, 197 funds reduced their exposure to XLF, while 47 funds sold all their holdings of XLF. However, 69 funds created new positions, and 228 funds increased their exposure to XLF.

Major institutional holders such as Moore Capital Management, Morgan Stanley (MS), UBS AG, Citigroup (C), and Goldman Sachs (GS) have increased their exposure to XLF in 2Q15. Among these, Moore Capital Management has added fresh holdings of XLF to its portfolio.

Institutions that have significantly reduced their exposure are BlackRock (BLK), JPMorgan Chase (JPM) and Partner Fund Management. Partner Fund Management has liquidated all its exposure to XLF.