Big Streamlining Step: Why Coca-Cola’s Selling 9 US Bottling Plants

Coca-Cola announced its plans to divest nine production facilities to three of its independent bottlers pursuant to letters of intent signed with these entities.

Oct. 5 2015, Published 11:57 a.m. ET

Sale of nine US production plants

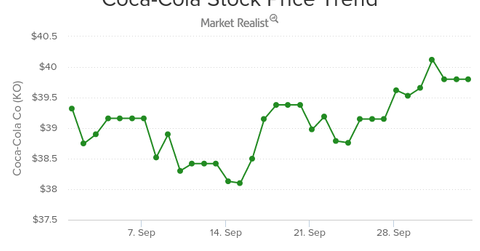

The Coca-Cola Company (KO) announced its plans to divest nine production facilities to three of its independent bottlers pursuant to letters of intent signed with these entities. This decision is in line with the company’s plan to reduce its exposure to bottling operations. Coca-Cola’s stock price increased by 1% to $39.15 in reaction to this announcement on September 24.

[marketrealist-chart id=702742]

Entities involved

The nine production facilities, which have an estimated net book value of $380 million, will be acquired by Coca-Cola’s three independent bottlers: Coca-Cola Bottling Co. Consolidated (COKE), Coca-Cola Bottling Company United, and Swire Coca-Cola USA. Below are the nine Coca-Cola bottling plants that will be acquired by these three independent bottlers:

- Coca-Cola Bottling Co. Consolidated: six facilities in Sandston, Virginia, including Baltimore and Silver Spring, Maryland; Indianapolis and Portland, Indiana, and Cincinnati, Ohio

- Coca-Cola Bottling Company United: one facility in New Orleans, Louisiana

- Swire Coca-Cola USA: two facilities, one in Phoenix, Arizona, and another in Denver, Colorado

The sale of these production facilities is expected to occur between 2016 and 2018.

Currently, Coca-Cola Refreshments USA, or CCR, owns and operates these facilities. CCR manages Coca-Cola’s bottling operations and product supply chain functions in North America. The company also disclosed the possibility of the sale of additional production facilities from CCR to independent bottlers.

Strong distribution network

Coca-Cola and PepsiCo (PEP) have extensive bottling and distribution network in North America and in international markets. Dr Pepper Snapple (DPS) relies on the distribution network of these beverage giants for the distribution of some its brands. With the closure of the strategic deal between Coca-Cola and Monster Beverage (MNST), Monster can now leverage Coca-Cola’s distribution network to further strengthen its energy drinks business.

Coca-Cola, PepsiCo, Dr Pepper Snapple, and Monster Beverage together account for 16.4% of the portfolio holdings of the Consumer Staples Select Sector SPDR Fund (XLP). The holdings of the iShares Russell 3000 ETF (IWV) have 1.6% combined exposure to these four beverage companies.

Reducing capital base

Coca-Cola has been strategically refranchising its bottling business in an attempt to move away from this low-margin, capital-intensive business. With the sale of the aforementioned nine production facilities, the company is moving a step further in reducing its capital base.

The company has also been strengthening its international bottling network. In August 2015, Coca-Cola announced the potential merger of Coca-Cola Enterprises (CCE), Coca-Cola Iberian Partners, or CCIP, and Coca-Cola Erfrischungsgetränke AG, or CCEAG, to form a new bottling entity.

Coca-Cola also announced the formation of a new National Product Supply System in the US to optimize its operations in the region. The next part of this series discusses this new system.