Vertex Pharmaceuticals’ 3-Pronged Business Model

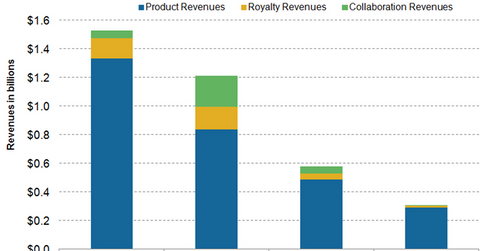

Vertex Pharmaceuticals’ (VRTX) business model includes revenues in three areas: products, royalties, and collaboration. There’s significant variability in royalty and collaboration revenues.

Sept. 25 2015, Published 11:46 a.m. ET

Revenues in three areas

Vertex Pharmaceuticals (VRTX) generates revenues in three areas: products, royalties, and collaboration.

Product revenues

Vertex Pharmaceuticals is considered the first and only company with therapies that target the underlying cause of the hereditary disorder cystic fibrosis (or CF). The company’s product revenues mainly originate from sales of Kalydeco (ivacaftor) for patients with CF who are older than six years of age and also have a certain mutation in a particular gene called cystic fibrosis transmembrane conductance regulator (or CFTR).

In July 2015, the FDA (U.S. Food and Drug Administration) also approved Vertex Pharmaceuticals’ Orkambi, a combination of lumacaftor and ivacaftor, for the treatment of CF patients aged 12 years and older.

In 2012 and 2013, Vertex Pharmaceuticals marketed Incivek (telaprevir) for genotype 1 hepatitis C (or HCV) patients. However, due to strong competition from new HCV drugs such as Gilead Sciences’ (GILD) Sovaldi and Harvoni and AbbVie’s (ABBV) Viekira Pak, Vertex has withdrawn Incivek from the US market and will wind down any remaining HCV business by 2015. This has led to a sudden drop in the company’s total revenues after 2014 compared to 2012 and 2013.

Royalty and collaboration revenues

In addition to product revenues, biotechnology companies such as Amgen (AMGN), Biogen, and Vertex Pharmaceuticals also earn royalty revenues. Vertex’s royalties are made up mainly of payments by past collaborators on sales of HIV drugs and telaprevir. Royalty rights related to telepravir, however, ended at the beginning of 2014. This has led to significant variability in the royalty and collaboration revenues Vertex Pharmaceuticals earns.

Investors can get diversified exposure to Vertex Pharmaceuticals while protecting themselves against excessive company-specific risks by investing in the iShares Nasdaq Biotechnology ETF (IBB). Vertex Pharmaceuticals accounts for 4.24% of IBB’s total holdings.