Simon Property Group’s Top Real Estate Tenants

Simon Property Group’s retail malls have two types of tenants, anchor and inline. Anchor tenants are large, big names, while inline tenants are small.

Sept. 17 2015, Updated 11:08 a.m. ET

Type of tenants

As a strategy, most retail malls have two types of tenants, anchor tenants and inline tenants. Anchor tenants are the key tenants with large stores and big names in the business. Anchor tenants attract other smaller tenants and customers to the mall.

By contrast, inline tenants are small tenants. They benefit from the footfall that anchor tenants draw to the mall. Anchor tenants pay lower rents and enter into long-term lease duration compared to inline tenants.

Major inline tenants

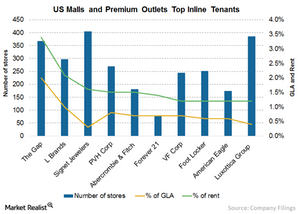

Simon Property Group’s (SPG) prime tenants, with their respective GLAs (Gross Leasable Area), are:

- Gap (GPS), with 2%

- L Brands (LB), with 1%

- PVH Corporation (PVH), with 0.8%

- Abercrombie & Fitch (ANF), with 0.7%

- Forever 21, with 0.7%

- Foot Locker (FL), with 0.6%

Other major tenants include:

The most profitable inline tenants for Simon Property include:

- Ascena Retail Group

- Children’s Place Retail Stores (PLCE)

- Express (EXPR)

- Genesco (GCO)

- Zale Corporation (ZLC)

Major anchor tenants

Typical anchor stores sell consumer staples, as in the case of grocery anchored centers, or are large and easily recognized retail chains, as is the case with centers anchored by Barnes & Noble (BKS) or Macy’s (M). Some of the other major anchor tenants of Simon Properties include:

- Sears Holdings

- The Bon-Ton Stores

- Dillard’s Department Stores

- J. C. Penney Company

- Hudson’s Bay

- Dick’s Sporting Goods

- Saks

- The Neiman Marcus Group

Investors looking for exposure in commercial real estate can invest in REIT ETFs. Simon Property Group and Public Storage (PSA) make up 8.16% and 4.06% of the Vanguard REIT ETF (VNQ) respectively. Equity Residential (EQR) comprised 6.7% holdings of the iShares Cohen & Steers REIT ETF (ICF).

In the next part of this series, we’ll discuss Simon Property’s acquisition strategy.