An Overview of AbbVie’s Business Model

AbbVie’s business model involves generating revenues through the sale of pharmaceutical products, which target some of the world’s most serious diseases.

Sept. 22 2015, Published 3:33 p.m. ET

AbbVie’s business model

AbbVie (ABBV) generates revenues mainly through the sale of pharmaceutical products. These products are targeted at some of the most complex and serious diseases in the world.

Product revenues

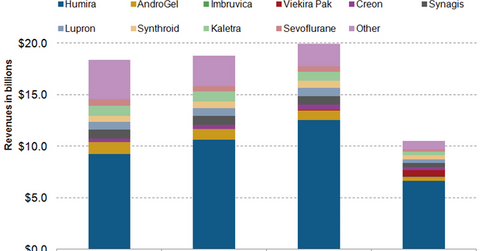

AbbVie is a leading biotechnology company with pharmaceutical products in segments such as autoimmune diseases, virology, liver diseases, renal diseases, neurological diseases, and women’s health–related diseases. The company has a strong portfolio of drugs such as Humira, Imbruvica, Viekira Pak, Creon, Synagis, Lupron, Synthroid, Kaletra, AndroGel, Sevoflurane, Duodopa, and dyslipidemia products.

Humira

Humira accounts for about 63% of AbbVie’s total revenues and targets diseases such as rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, and Crohn’s disease. Despite being a current market leader in the rheumatoid arthritis segment, Humira is expected to face tough competition from biosimilar drugs developed by Amgen (AMGN), Biogen (BIIB), and Merck (MRK).

With Humira’s patent expiring in 2016, these biosimilars pose a substantial risk to the drug’s profit margins. To know more about rheumatoid arthritis, please refer to Humira Takes Top Spot for Rheumatoid Arthritis Drugs.

Other drugs

In December 2014, AbbVie entered the liver diseases market segment with its new drug Viekira Pak. A competitor for Gilead Sciences’s Harvoni, Viekira Pak substantially increased competition in the hepatitis C market. Additionally, AbbVie has drugs such as Kaletra and Norvir for treating human immunodeficiency virus (or HIV) infection and Synagis for respiratory syncytial virus (or RSV) infection.

AbbVie also offers drugs such as AndroGel, Creon, and Synthroid, which target conditions arising from the deficiency of certain hormones. The company also sells oncology, cardiovascular, metabolic, and anesthesia drugs. Though these drugs don’t account for a large portion of AbbVie’s revenues, they help to diversify the company’s revenues across several therapeutics markets.

Investors can get exposure to AbbVie’s strong product portfolio while avoiding unique company risks by investing in the VanEck Vectors Pharmaceutical ETF (PPH). PPH holds 4.84% of its total holdings in AbbVie.