Is the Market Excited about Goldcorp’s Recent Moves?

Goldcorp (GG) announced on August 27 that it has bought the remaining 30% stake of El Morro from New Gold (NGD).

Sept. 8 2015, Updated 1:15 p.m. ET

Inking the deals

Goldcorp (GG) announced on August 27 that it has bought the remaining 30% stake of El Morro from New Gold (NGD). In a separate release on the same day, Goldcorp said that it will combine this project with one of Teck Resources’ (TCK) projects in Chile to form a 50:50 joint venture. This deal is expected to be mutually beneficial for both the parties concerned.

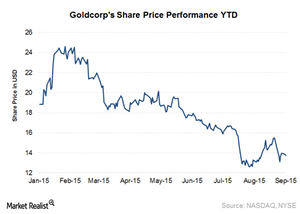

Stock price performance

Goldcorp’s stock price surged 4.3% after the announcement of these two deals, likely because the market is excited about the synergies that these two projects can offer on a combined basis. In this series, we’ll discuss these two deals in detail and look at the impact that they can have on the future of the company.

About Goldcorp

Goldcorp (GG) is a senior gold producer based in Canada. It has four mines in Canada and the US. It also has three mines in Mexico and another three mines in Central and South America. Canada and the US account for 45% of Goldcorp’s production. Mexico accounts for 31%, and Central and South America account for 24%.

Goldcorp has the third largest gold reserves in the world, totaling 49.6 million ounces. In comparison, Barrick Gold (ABX) has 93 million ounces and Newmont Mining (NEM) has 82.2 million ounces in gold reserves.

Investors can access the gold industry through gold-backed ETFs such as the SPDR Gold Trust ETF (GLD) and the VanEck Vectors Gold Miners Index ETF (GDX). ABX, NEM, and GG make up 20.2% of GDX’s holdings.