Comp: Do Gold Miners with an Exposure to Copper Face Downside?

Newmont Mining (NEM) has exposure to gold and copper. In 2Q15, it generated 18% of its revenue from copper. The rest of its revenue was from gold sales.

Sept. 25 2015, Published 3:39 p.m. ET

Revenue composition

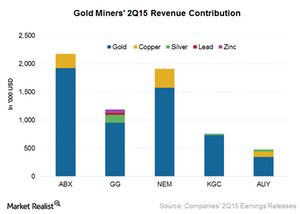

Understanding gold miners’ (GDX) revenue composition is important because the mineralization of each mine is unique. So, while some produce copper, others produce silver, lead, or zinc as by-products along with gold. This causes varying exposure among miners to the prices of these commodities. In turn, this impacts their profitability.

Miners with copper exposure

In 2Q15, Barrick Gold (ABX) generated 12% of its revenue from copper. Barrick announced the sale of 50% of its interest in the Zaldivar copper mine in Chile to Antofagasta during 2Q15. The company also mentioned that it doesn’t have plans to expand its existing copper production. Going forward, we’ll likely see a lower contribution from copper to Barrick’s revenue.

Newmont Mining (NEM) has exposure to gold and copper. In 2Q15, it generated 18% of its revenue from copper. The rest of its revenue was from gold sales. The company has exposure to copper mainly through the Batu Hijau copper and gold mine in Indonesia and the Phoenix and Boddington mines. Recently, Newmont’s exposure to copper rose as the Batu Hijau mine. It reached a high-grade area. As a result, its copper production was 153% higher YoY (year-over-year) in 2Q15.

Goldcorp (GG) is more diversified in terms of metals. While 80% of its 2Q15 revenue was from gold, 12% was from silver, 5% was from zinc, and 3% was from lead. These metals are essentially a by-product of mining gold at some of Goldcorp’s gold sites.

In 2Q15, Yamana Gold’s (AUY) revenue was 20% from copper and 8% from silver. The rest was from gold sales.

In contrast, Kinross Gold (KGC) produces silver as a by-product at some of its gold mines. The proportion of the silver revenue to the overall revenue is less than 1%. It isn’t significant.

Investors can also access the gold industry through gold-backed ETFs like the SPDR Gold Trust ETF (GLD). Kinross Gold accounts for 2.80% of GDX’s holdings.

Is the downside related to copper?

Copper prices have been weak throughout 2015. The prices hit multi-year lows. Most of the demand weakness is due to growth concerns in China. JPMorgan Chase (JPM) is also concerned about gold miners’ copper exposure. It warned that lower copper prices could mean trouble for miners like Barrick Gold and Newmont Mining in 2016.