Comp: Analyzing the Financial Leverage for Gold Miners

Barrick Gold’s (ABX) financial leverage is among the highest in the industry. Barrick has a high debt-to-assets ratio of 40%.

Oct. 6 2015, Updated 7:06 p.m. ET

Leverage ratios

Investors in the gold mining industry need to know a company’s debt levels. High levels of debt can put a strain on a company’s credit ratings. High debt levels can also weaken a company’s ability to increase production through exploration or acquisitions. It’s important to note that during the industry downturn, companies with higher leverage usually underperform. If the gold prices do recover, companies with higher leverage ratios can generally outperform those with a lower leverage.

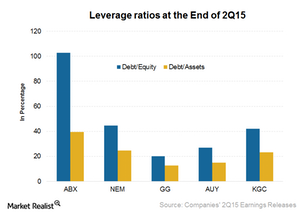

Barrick has the highest financial leverage

Barrick Gold’s (ABX) financial leverage is among the highest in the industry. Barrick has a high debt-to-assets ratio of 40% compared to Newmont Mining’s (NEM) 25%, Kinross Gold’s (KGC) 23%, Yamana Gold’s (AUY) 15%, and Goldcorp’s (GG) 13%. Barrick’s debt-to-equity ratio shows a debt-equity mix in the company’s capital structure. It’s also the highest at 102.90%.

Newmont Mining’s (NEM) debt ranking is also high in the overall gold sector. Its debt-to-equity ratio is also high at 45%—compared to other senior and intermediate gold miners, except Barrick. Recently, Newmont attempted to reduce its debt by non-core asset sales. The most recent was the sale of its Waihi mine in New Zealand to Oceana Gold. While the market isn’t concerned about the company’s debt repayment ability, debt servicing will put pressure on the margins. Investors should be concerned about this.

Goldcorp and Newmont form 13.60% of the VanEck Vectors Gold Miners Index (GDX) while the SPDR Gold Trust (GLD) is a good way to gain exposure to spot gold prices.

Companies with the strongest balance sheet can weather the weakness longer than their highly leveraged peers.

In the next part, we’ll look deeper into gold mining companies’ cash holdings and their near and long-term needs to see if they can survive the current volatile and weak commodity price environment.