Analyzing the Performance of Boeing Stock in 2016

In this series, we’ll assess Boeing’s (BA) key indicators for 4Q16. We’ll look at analyst estimates for BA’s 4Q16 performance and assess whether the indicators justify the estimated earnings results.

Nov. 20 2020, Updated 1:02 p.m. ET

4Q16 expectations

The Boeing Company (BA) is expected to report its fourth quarter results on January 25, 2017. For 4Q16, analysts are estimating revenues to fall 1.6% to $23.2 billion. Its EBITDA[1. earnings before interest, tax, depreciation, and amortization] is expected to increase 48% to $2.6 billion.

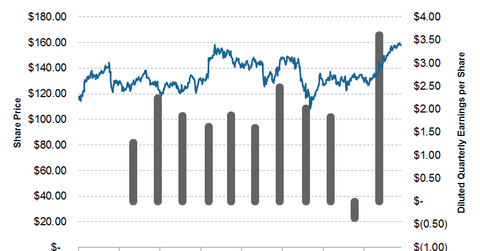

Stock gains

In 4Q16, Boeing (BA) stock rose ~17.6%. The stock rose 1.4% in 3Q16, and it rose ~2.3% in 2Q16. In 1Q16, the stock had fallen as much as 12% owing to the SEC investigation of the Boeing 787 Dreamliner project. However, the Dreamliner’s accounting and profitability issues continue.

2016 performance

After being in the red until mid-November 2016, Boeing (BA) stock saw a significant rise in December. Things started looking up after the company booked its deal with Iran Air.

In 2016, Boeing stock rose almost 8.5%. BA’s defense peers United Technologies (UTX), Lockheed Martin (LMT), and General Dynamics (GD) rose 13.8%, 14.4%, and 23.5%, respectively, during the same period.

The SPDR Dow Jones Industrial Average ETF (DIA), which tracks the DJI, gained 12.7% in the same period. The broader market, which is tracked by the SPDR S&P 500 ETF (SPY), has gained ~8.7%.

Series overview

In this series, we’ll assess Boeing’s (BA) key indicators for 4Q16. We’ll also look at analyst estimates for BA’s 4Q16 performance and assess whether the indicators justify the estimated earnings results.

You can also read our complete analysis of Boeing’s 3Q16 results in Boeing Flew High in 3Q16: Does It Have More Room to Run?