Could Alcoa’s Split Create Shareholder Value?

As an Alcoa (AA) shareholder, you might like to know whether the split will create value. The value, in this case, would basically mean whether the two separate companies would be worth more than the combined entity.

Dec. 4 2020, Updated 10:53 a.m. ET

Shareholder value

As an Alcoa (AA) shareholder, you might like to know whether the split will create value. The value, in this case, would basically mean whether the two separate companies would be worth more than the combined entity. Well, for that question, we’ll have to wait for the companies’ listing, which is scheduled for the second half of 2016. However, there could be a difference in the way markets value these two companies. Let’s take a look.

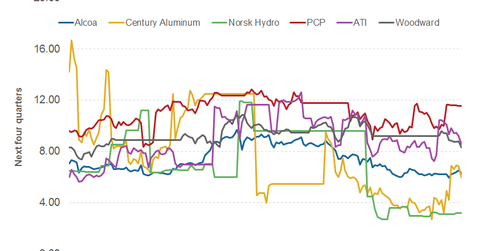

Commodity assets are valued lower

The chart above shows the forward EV-EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization) for the selected companies. As you can see, companies primarily involved in the commodity aluminum business—including Century Aluminum (CENX) and Norsk Hydro (NHYDY)—have lower valuation multiples. On the other hand, companies involved in the value-add components space like Allegheny Technology (ATI), Woodward (WWD), and Precision Castparts (PCP) have historically traded at a higher valuation multiple.

Alcoa’s valuation multiples have been somewhere between pure-play commodity (DBC) companies and companies in the value-add space.

What could happen after the split?

Alter the split, markets will value Alcoa’s commodity and value-add business separately. This should help in the price discovery of the two assets. The value-add company could command a premium compared to the upstream company, which we see from looking at the growth prospects and prevailing low commodity price scenario.

However, both upstream and value-add companies would have separate characteristics and investment propositions. As an investor, you can decide whether you want to stay in the cyclical commodity business or the value-add component space. Please note that both businesses would have their own risk-to-return characteristics.

Meanwhile, another pertinent question currently would be “why now?” We’ll discuss this in the next part of this series.