Woodward Inc

Latest Woodward Inc News and Updates

Arconic’s Tough Beginning: Controversies and Battles

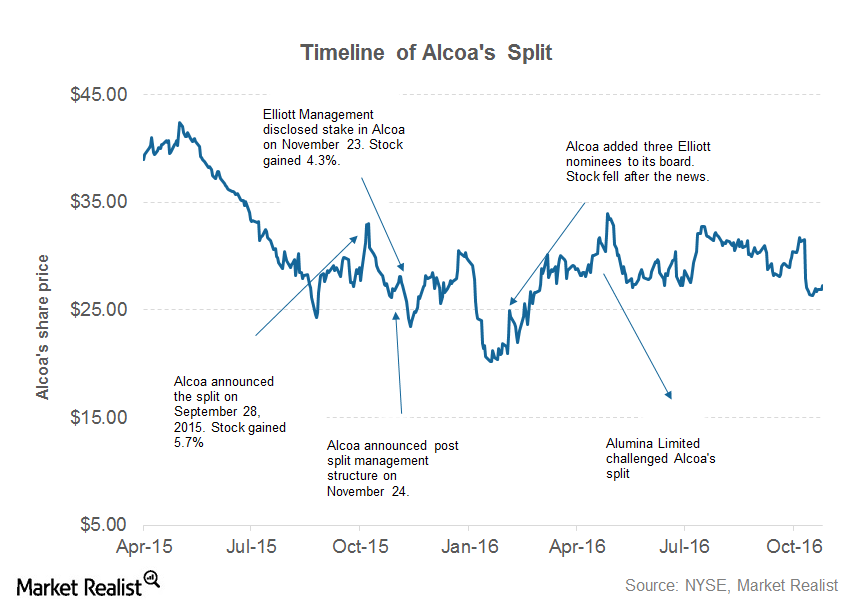

Arconic is scheduled to release its 1Q17 earnings on April 25. ARNC was listed as a separate entity on November 1, 2016, when Alcoa split into two entities.

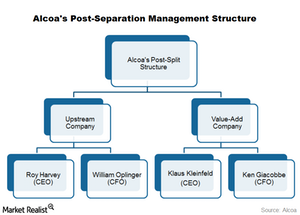

No Surprises in Alcoa’s Post-Separation Management Structure

On November 24, Alcoa announced the executive management structure to be introduced following its split.