What Does US Term Premium Indicate?

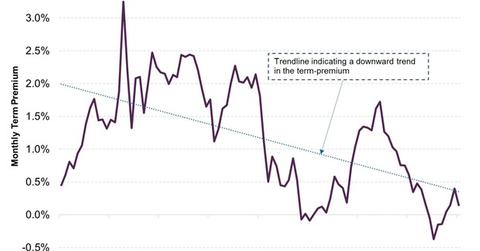

Over an eight-year period, the term premium on a ten-year US security rose to 3.25% in October 2008. It saw a low of -0.37% in January 2015.

Aug. 31 2015, Updated 11:51 a.m. ET

What is term premium?

Term premium is the extra yield required by bond investors to hold on to a long-term bond in place of a series of short-term bonds. For instance, assume the interest rate on a ten-year security is 2.1%. Also assume the interest rate on a one-year security is expected to average 0.9% in the coming ten years. In this case, the term premium for holding the ten-year security is 1.2%, or 120 basis points.

Unlike yields and spreads, term premiums are not visible directly. Tobias Adrian, Richard K. Crump, and Emanuel Moench at the Federal Reserve Bank of New York have estimated term premiums for several maturities. The above graph represents the term premium estimated by them for the ten-year security.

In the eight-year period shown in the graph, the term premium on the ten-year US security rose to 3.25% in October 2008. On the other hand, it saw a low of -0.37% in January 2015. Usually, term premium, like yield curve, is positive due to the higher compensation required to hold on to a longer-term security.

Although the premium has returned to positive territory since April 2015, it has remained low, with July seeing another downturn in the premium. In August, the daily values of the term premium on the ten-year security have turned lower even further, with estimates for two dates showing negative premium.

What does it mean for investors?

One of the reasons for the fall in term premium on the ten-year security is the reduced worry about inflation, which puts a downward pressure on term premiums of longer-term securities.

Another reason for the fall could be enhanced demand for the security during uncertain times. With political trouble in Greece and weakness in the Chinese economy, foreign investors may be seeking shelter in longer-term Treasuries, thus leading to a fall in term premiums.

Investors should keep track of term premiums, especially on longer-maturity securities, as it can give them an indication of perceived risk and also an outlook on inflation. This will help investors form opinions about the impending rate hike in the United States.

A greater chance of a rate hike should put upward pressure on long-term yields (IEF) (TLT). A rise in rates would not only impact bond investors, it would also affect loans, from car loans to mortgages, which will become expensive.

The auto industry has begun to see growth for automakers General Motors (GM) and Fiat Chrysler Automobiles (FCAU) with a rise in sales in recent months. Homebuilders such as Lennar (LEN), DR Horton (DHI), and KB Home (KBH) have posted good results for 2Q15. A rise in rates could impact loans in these sectors, which could have a negative impact on economic output.

In the next article, we’ll look at how investment-grade bond yields have moved in the past year.