US Crude Production Dropped in Week Ended July 24, but Why?

According to data from the U.S. Energy Information Administration, US crude production dropped to 9.4 million barrels per day in the week ended July 24.

Aug. 6 2015, Updated 9:06 a.m. ET

Spectra Energy led the pack of oil firms last week

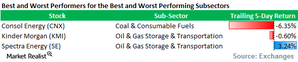

As seen in the table below, Consol Energy (CNX) posted the most losses in the Energy Select Sector SPDR ETF (XLE) last week. Meanwhile, Kinder Morgan (KMI) and Spectra Energy (SE) from the storage and transportation subsector were respectively the worst and best performers. Together, these three firms represent 7.45% of the XLE.

Kinder Morgan (KMI), which reported 2Q15 earnings on July 15, missed 2Q consensus revenue estimates by 14%.

US oil drillers increase rig count despite weak oil prices

US crude dropped by close to 20% over the last month. Rig counts, however, seem to indicate that oil producers are not that disturbed by the nose-dive in oil prices. The chart below shows that the number of active US oil rigs rose to 664 during the week ended July 31, up by five compared with the previous week. This follows a significant addition of 21 rigs in the week ended July 24, which was the greatest weekly increase in over a year.

Oil prices are still being pressured by record crude-pumping in Iraq and Saudi Arabia. As well, the strength of the US dollar and the prospect that Iranian crude could soon enter the markets have weighed down the price of crude.

Cuts to capital expenditure beginning to sting US crude production

According to data from the U.S. Energy Information Administration, US crude production dropped to 9.4 million barrels per day in the week ended July 24. This follows nine weeks at an average of 9.6 million barrels per day. The recent drop in US production is probably an early sign that energy firms’ cuts to capital expenditure that began in 2H14 are starting to bite.

In the next part of this series, we’ll explore why the annual stock performance of smaller oil drillers such as Cimarex Energy (XEC) is on par with that of larger integrated firms such as Exxon Mobil (XOM).