Teva Can Benefit by Acquiring Allergan Generics

The combined Teva–Allergan generics entity should have approximately 320 Abbreviated New Drug Applications (or ANDAs), including 110 first-to-file ANDAs (or FTF) in the US.

Dec. 4 2020, Updated 10:53 a.m. ET

Business model transformation

In this part of the series, we will look at how Teva Pharmaceutical Industries (TEVA) could benefit by acquiring the generics business of Allergan, previously known as Actavis. Teva has set a minimum target of $4.3 billion in profits for 2016.

The Teva–Allergan deal is a part of the business model transformation process adopted by Teva to achieve its profitability targets. To learn more about Teva’s evolving business, please read .

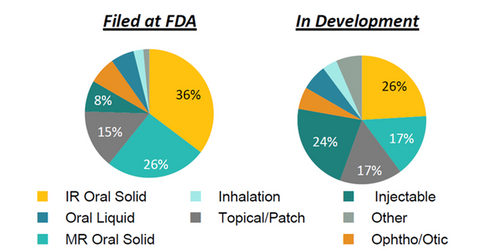

The above graph shows that Allergan’s generic research and development (or R&D) capabilities are well-diversified across its various complex generics and dosage forms.

Since 2014, Teva has been changing its business model from being volume-driven to value-driven. The company aims to shift its product portfolio to high-value complex generics products, mainly through acquisitions. With a strong generics R&D pipeline, Allergan has been a suitable fit for Teva’s growth strategy.

ANDA and FTF

Allergan is a leading generics manufacturer and offers branded and unbranded generics, as well as over-the-counter (or OTC) pharmaceutical products. The combined Teva–Allergan Generics entity should have approximately 320 Abbreviated New Drug Applications (or ANDAs), including 110 first-to-file ANDAs (or FTF) in the US. Prior to the deal, Teva had only 130 ANDAs while competitors such as Allergan (AGN) and Mylan (MYL) each had about 200 ANDAs.

An ANDA is filed in the US for the approval of a generic drug for an existing licensed drug. A generic manufacturer that is the first to file an ANDA for a particular branded drug enjoys 180 days of exclusive marketing rights for the generic of that drug. This exclusivity period is used to reimburse costs borne by the generic manufacturer in litigation-related and other expenses, intended to prove that the patent of the branded drug is invalid or was not violated in the generic production process.

Teva’s strong R&D pipeline is expected to translate into revenues of ~$28 billion by 2018. The new Teva would be the ninth-largest global pharmaceutical company. This allows the company to compete effectively with Johnson & Johnson and Novartis (NVS), which are the top two pharmaceutical companies in the world.

Instead of directly investing in the stock, investors can also take a diversified exposure to Allergan by investing in the Health Care Select Sector SPDR ETF (XLV). Allergan accounts for 4.82% of XLV’s total holdings.