Making Sense of the ‘September Effect’ on Equities

The dreaded September effect is not limited to US stocks (SPY). It’s relevant to markets around the globe (ACWI).

Sept. 8 2015, Updated 7:05 a.m. ET

However, investors should note that this “September swoon” tendency has dissipated in recent years. Looking back at S&P 500 returns over only the last 25 years, September’s average monthly return is roughly -0.4 percent, while the median monthly return is actually positive. In addition, big declines in September haven’t been as frequent as was the case prior to 1990. A simple explanation is that as investors have become aware of the bias, they have increasingly reacted by “pre-positioning”, i.e. selling in August.

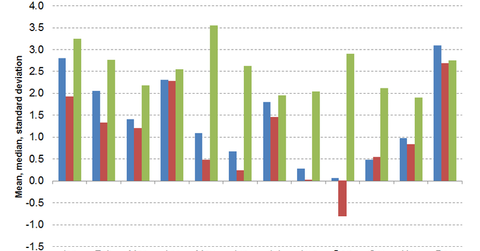

Market Realist – The dreaded September effect is not limited to US stocks (SPY). It’s relevant to markets around the globe (ACWI). The graph above shows the mean, median, and standard deviations of monthly stock returns from a study conducted on 70 countries.

According to academic research by Vichet Sum, September offers the lowest mean monthly returns of 0.07% globally. It’s the only month with a negative median of -0.76. The standard deviation for the month is also among the highest, indicating higher chances of volatility (VXX).

The graph above shows the percentage of countries with positive or negative returns every month, as Vichet Sum observes. More than 60% of the 70 countries observed showed negative returns in September.

Many analysts have tried to understand the reasons behind the September effect. The negative impact on markets (VTI)(VOO) has often been attributed to seasonal behavioral bias. Investors reshuffle their portfolios at the end of summer and try to cash in. The other reason is mutual fund activity. Most mutual funds do some tax loss harvesting in the month and cash in their holdings.

Though the September effect is well documented and its impact is undeniable, its relevance has receded somewhat in the last few years. Most investors are aware of seasonal gyrations in the market in September, so they position their portfolios accordingly beforehand.

Read on to the next part of this series to learn the other major factors that could affect investors in September!