Rose Rock Midstream: Top Midstream MLP Loser on August 25

Rose Rock Midstream (RRMS) was the top loser among midstream MLPs at the end of trading on Tuesday, August 25. It fell 4.71% in a single trading session.

Nov. 20 2020, Updated 2:25 p.m. ET

Top losers

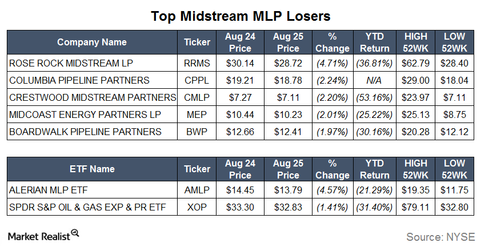

In the last part of this series, we saw the top five midstream MLP gainers on August 25. In this part, we’ll discuss the top five midstream MLP losers on the same day.

Rose Rock Midstream

Rose Rock Midstream (RRMS) was the top loser among midstream MLPs at the end of trading on Tuesday, August 25. It fell 4.71% in a single trading session yesterday. With yesterday’s loss, Rose Rock Midstream’s YTD (year-to-date) returns fell to -36.81%. The partnership is involved in crude oil gathering, transportation, storage, and marketing. SemGroup (SEMG) owns 100% of Rose Rock Midstream’s general partner.

Columbia Pipeline Partners

Columbia Pipeline Partners (CPPL) is next on our list of the top five midstream MLP losers on August 25. It fell 2.24% yesterday. The partnership is engaged in the natural gas transmission and storage business. Columbia Pipeline Partners started trading in February 2015. Since then, the stock has returned -29.89%

Other losers

Crestwood Midstream Partners (CMLP), Midcoast Energy Partners (MEP), and Boardwalk Pipeline Partners (BWP) were among the top five midstream MLP losers on Tuesday, August 25. They fell 2.20%, 2.01%, and 1.97% in the last trading session, respectively. They have returned -53.16%, -25.22%, and -30.16% YTD.

Crestwood Midstream Partners’ poor market performance can be attributed to falling NGL (natural gas liquid) and crude oil prices affecting its Crude Oil and NGL services segment. For an in-depth analysis of Crestwood Midstream’s recent operating and market performance, read Crestwood Midstream’s 2Q15 Results: Highlights for Investors.

The Alerian MLP ETF (AMLP) and the Global X MLP & Energy Infrastructure ETF (MLPX) have returned -21.29% and -22.05% YTD. Crestwood Midstream accounts for ~1.02% of AMLP. For context, the upstream energy company heavy SPDR S&P Oil & Gas Exploration & Production ETF (XOP) has returned -31.40% YTD.