Why Did REITs Come into Existence?

US REITs came into existence in 1960 when President Eisenhower signed the REIT Act contained in the Cigar Excise Tax Extension.

Aug. 24 2015, Updated 11:14 p.m. ET

What’s a REIT?

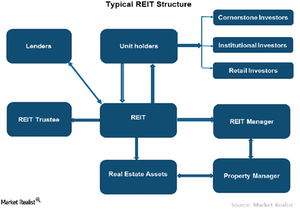

A REIT is a company that acquires, owns, and operates income-producing real estate assets. Some REITs are also involved in financing real estate. Assets owned by a REIT include apartments, office buildings, shopping malls, hotels, resorts, warehouses, self-storage facilities, mortgages, and loans.

Why did REITs come into existence?

US REITs came into existence in 1960 when President Eisenhower signed the REIT Act contained in the Cigar Excise Tax Extension. REITs were created to provide access to individual investors to earn income through commercial real estate ownership. In order to achieve this, Congress decided to follow the equity structure of ownership. Just as the company shareholders benefit from an exposure in a stock, REIT shareholders earn proportionate income through owning a REIT unit.

Looking ahead

In this series, we’ll discuss the importance of REITs to average investors. We’ll provide a complete business overview of the REIT industry. We’ll explore key points that influence the industry. We’ll also run through a profile of major players like Simon Property Group (SPG), Public Storage (PSA), Equity Residential (EQR), Health Care REIT (HCN), Ventas (VTR), and Boston Properties (BXP). At the end of the series, we’re going to discuss REIT ETFs like the Vanguard REIT ETF (VNQ), the iShares U.S. Real Estate ETF (IYR), and the iShares Cohen & Steers REIT ETF (ICF).

Content

REITs basics

- Why REITs Came Into Existence?

- What are the Regulatory Requirements to Qualify as a REIT?

- Must-Know: How REITs Have Evolved Over the Years

- What are the Advantages and Disadvantages of Investing in REITs?

Sectoral REITs

- What are the Different Types of REITs?

- What are the Different Sectoral Equity REITs Available to Investors?

- Must-Know: Residential Sector is One of the Largest REITs Segment

- Affordable Health Care Boosting Health Care REITs

- Industrial REITs Buoyed By Solid Economic Fundamentals

- Fortunes of Office REITs are Linked to Robust Job Growth

- Lodging and Resorts REITs are into Cyclical Business

- Rising Consumer Spending to Propel Retail REITs

- Shopping Center REITs Are Sensitive to Economic Cycles

- Self-Storage REITs – Who Doesn’t Want Storage Space?

- Technological Advancement May Further Boost Data Center REITs

Financial parameters

- What are the Factors Driving REIT Earnings?

- REITs Dividend Yield is Higher Compared to Other Asset Classes

- REITs Provide Better Returns than Other Asset Classes

Valuation

- What are the Methods Use for REITs Valuation?

- Why You Should Know About the Capitalization Rates

- Most of the REITs are Trading Close to their Historical Multiples

Global REITs, indexes, and ETFs

- How Global REIT Industry Followed US REIT Model

- REIT ETFs Offer Alternative Investment Option