Ventas Inc

Latest Ventas Inc News and Updates

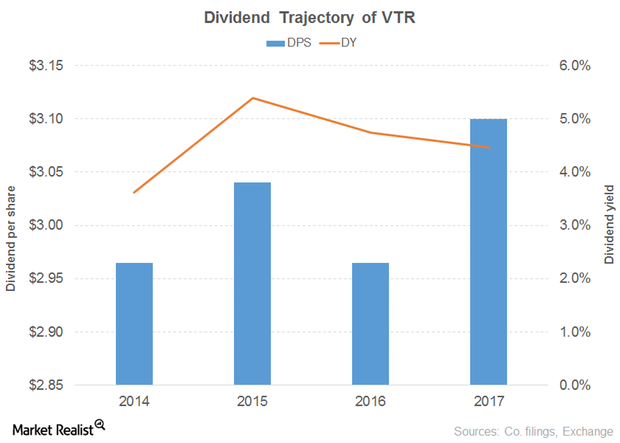

How Ventas’s Dividend Yield Compares

Revenue and earnings Ventas (VTR) is a major REIT in the United States and Canada. The company’s revenue growth slowed from 18% in 2015 to just 5% in 2016. The growth was driven by all of its segments, through resident fees and services, office building and other service revenue, and income from loans and investments, […]

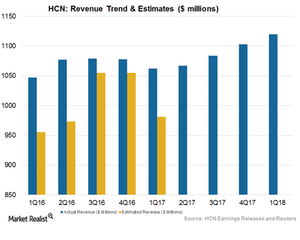

Will Welltower Maintain Its Business Momentum in the Future?

Welltower’s (HCN) strategic presences in high-barrier and affluent markets help it to maintain its leadership in the healthcare infrastructure industry.

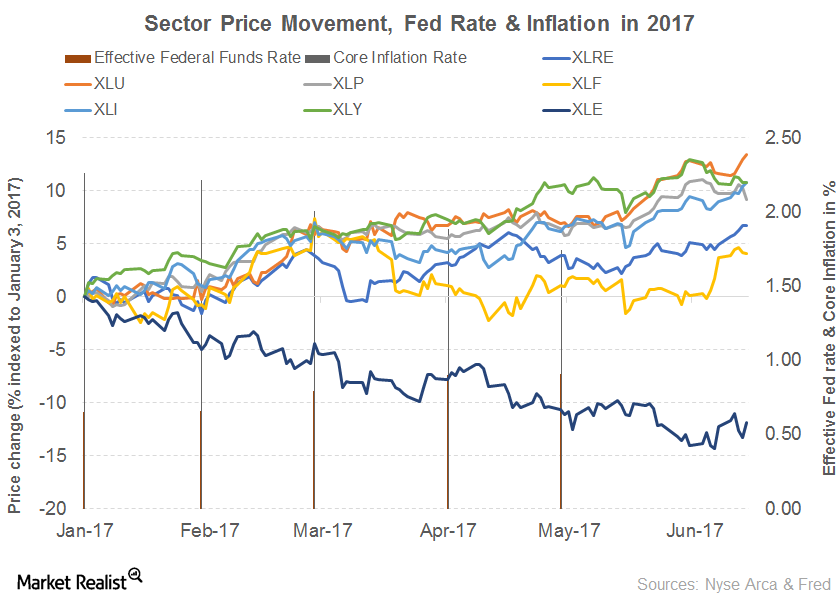

Comparing Growth and Value Stock Sectors

The SPDR S&P 500 Growth ETF (SPYG) has generated a YTD return of 13.3% versus 4.3% from the SPDR S&P 500 Value ETF (SPYV).

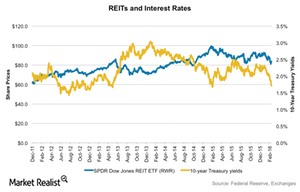

How Would Negative Interest Rates Impact REITs?

A fall in interest rates makes REITs more attractive dividend-yielding investments compared to bonds. This is because REITs have been traditionally viewed as dividend-yielding investments.

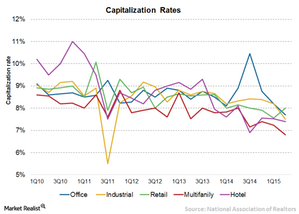

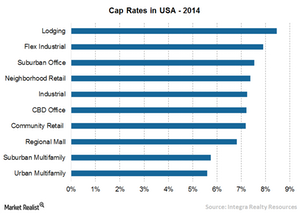

REIT Capitalization Rates Fall as Prices Surge

Average capitalization rates in 2Q15 fell to 7.5% across all the property types compared to 8.35% in 2Q14.

Why Are Capitalization Rates Important for Investors?

The capitalization rate, or cap rate, is an important concept in the commercial real estate industry. It’s defined as an initial yield on a real estate investment.

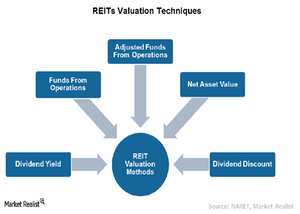

What Methods Are Used to Determine REITs’ Valuation?

Traditional valuation methods don’t apply to REITs because their operations are different from traditional companies. REITs are valued based on three main techniques.

SPY’s Struggle with Wall Street Continues

Of the 502 constituent stocks of SPY, only 23 recorded positive returns on Wall Street on August 20. Only seven stocks traded at a closing price above their moving averages.

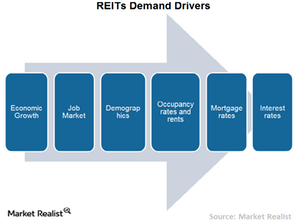

What Factors Drive REIT Earnings?

Economic growth is the major factor that determines REITs’ growth. An uptick in economic fundamentals positively affects the REITs by increasing business growth.

What Are the Different Types of REITs?

There are three types of REITs—equity REITs, mortgage REITs, and hybrid REITs. Mortgage REITs lend money to landlords and their operators to purchase a property.

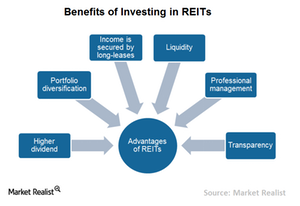

Advantages and Disadvantages of Investing in REITs

Every investment comes with certain advantages and disadvantages. REITs are no exception. There are benefits and risks associated with investing in REITs.

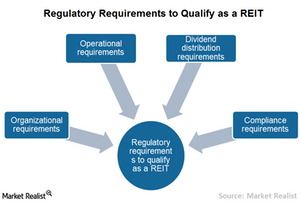

What Are the Regulatory Requirements to Qualify as a REIT?

To qualify as a REIT, a company must make REIT election by filing a Form 1120-REIT with the IRS. This is essential to reduce or eliminate corporate tax.