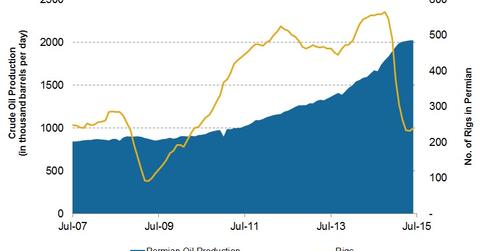

Permian Shale’s July Crude Oil Production Growth Slowest in 2015

The EIA estimates that the Permian Shale’s July crude oil production was ~2.02 MMbpd, only 0.1% higher than June’s production total. However, this is a 24% increase over production in July 2014.

Aug. 19 2015, Published 1:16 p.m. ET

Permian Shale oil production

On August 10, 2015, the EIA (U.S. Energy Information Administration) released its latest Drilling Productivity Report. The EIA estimates that the Permian Shale’s July crude oil production amounted to ~2.02 MMbpd (million barrels per day), which is only 0.1% higher than June’s production total. However, this is a 24% increase over production in July 2014.

Month-over-month, the Permian Shale’s July crude oil production growth was the lowest in 2015. Permian Shale oil production increased from 843,400 barrels per day in July 2007 to 2.02 MMbpd in July 2015. That’s an increase of 140% in eight years.

Monthly additions from one average rig

The EIA calculates that the average Permian Basin rig added production of 314 bpd (barrels per day) in July 2015, a 46% gain since July 2014. The horizontal drilling and hydraulic fracturing process has unlocked huge oil reserves in the Permian Basin. The most productive Permian formations are the Spraberry, Wolfcamp, and Bone Spring formations.

Rigs in the Permian Basin

In July, the number of rigs working in the Permian Basin was 241, up from 232 in June. There were 565 rigs active in the Permian Basin in November last year, the highest rig count in the past seven years. The number of active rigs in the United States has fallen significantly in the past year. For more on this topic, read Permian Basin Leads the Crude Oil Rig Count Revival.

What this means for Permian producers

Higher crude oil production should benefit energy producers operating out of the Permian Basin. Active oil and gas producers in the Permian Basin include Concho Resources (CXO), RSP Permian (RSPP), EOG Resources (EOG), Laredo Petroleum (LPI), and Matador Resources (MTDR). RSPP makes up 1.56% of the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). EOG Resources comprises 2.99% of the iShares US Energy ETF (IYE).

If the Permian Basin’s oil production rises, midstream operators transporting oil and gas in this region also benefit. These include MLPs like Magellan Midstream Partners (MMP), Regency Energy Partners (RGP), Plains All American Partners (PAA), and Energy Transfer Partners (ETP).

The Bakken is one of the most prolific crude oil shales in the United States. In the next part of this series, we’ll find out why.