Barrick Gold in 2Q15: The Benefits of Asset Monetization

So far, Barrick has achieved 90% of its 2015 debt reduction target of $3 billion, mainly thanks to asset monetization.

Aug. 24 2015, Updated 9:05 a.m. ET

Asset monetization

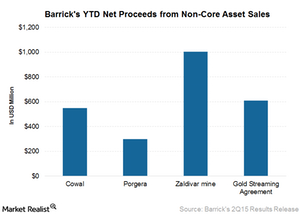

Barrick Gold (ABX) is selling non-core assets so it can operate as a leaner organization in a weaker commodity price environment. It also wants to reduce its debt. In 1Q15, Barrick sold its Cowal mine and a 50% stake in the Porgera joint venture. For more on these sales, read Barrick Gold Takes Key Steps towards Debt Reduction in 2015.

In this article, we’ll look at the extent to which Barrick’s recent asset monetization can help the firm reduce its debt.

50% sale of Zaldivar Mine

On July 30, Barrick announced the sale of 50% of its Zaldivar mine to Antofagasta (ANFGY) for a consideration of $1.005 billion in cash. Zaldivar is a copper mine in Chile, and going forward, Barrick’s management wants to focus on gold assets in safe jurisdictions only. Antofagasta has considerable experience operating in Chile. Barrick’s management thinks there could also be other potential synergies between the two firms.

Gold and silver streaming agreement

Barrick also announced a gold and silver streaming agreement with Royal Gold (RGLD) on August 5. The stream involves production linked to Barrick’s 60% interest in the Pueblo Viejo mine, which is located in the Dominican Republic. It’s operated as a joint venture between Barrick with 60% and Goldcorp (GG) with 40%.

Royal gold will pay cash upfront totaling $610 million, plus make ongoing cash payments for gold and silver that’s delivered under the agreement. This agreement monetizes Pueblo Viejo’s value in a weak price environment while preserving its exposure to higher metal prices in the future.

The SPDR Gold Trust (GLD) tracks spot gold prices, and the iShares Silver Trust (SLV) tracks spot silver prices.

Six more assets up for sale

On top of the assets already sold, Barrick has identified six more non-core assets for sale:

- Bald Mountain

- a 50% share in Round Mountain

- Golden Sunlight

- Ruby Hill

- Spring Valley

- Hilltop

Management mentioned during the call that these assets are generating substantial interest from investors.

So far, Barrick has achieved 90% of its debt reduction target of $3 billion for 2015, mainly thanks to asset monetization. Going forward, more asset sales should reduce Barrick’s financial leverage and boost its share price. We’ll look more closely at Barrick’s debt profile in our next article.