The Rationale behind the Sale of Mondelez’s Coffee Business

The primary reason behind the sale of Mondelez’s coffee business was so Mondelez could focus more on its core snack food business.

July 20 2015, Updated 1:06 p.m. ET

Significant contribution

In part 1 of this series, we looked at the spin-off of Mondelez International’s (MDLZ) coffee business and the creation of Jacobs Douwe Egberts, a new joint coffee venture. Mondelez’s coffee business accounted for 11% or $3.8 billion of its fiscal 2014 revenue. It’s also a high margin business with significant growth opportunities. So what’s behind Mondelez’s decision to spin off its coffee business?

Focus on core snack business

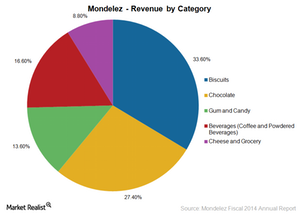

The primary reason behind the sale of Mondelez’s coffee business was so Mondelez could focus more on its core snack food business. Now that the spin-off is completed, Mondelez will derive ~85% of its net revenue from biscuits, chocolate, gum, and candy, up from 75% in fiscal 2014. Coffee and powdered beverages like Tang accounted for 16.6% of its fiscal 2014 net revenue.

By dedicating its resources to the snack food business, Mondelez will be better positioned to compete with snack food giants like PepsiCo (PEP). Based on the data provided in PepsiCo’s 2014 annual report, PepsiCo led the US savory snack market in 2014 with a 36.4% market share. Kellogg (K) and Mondelez held 6.8% and 5.3% market share, respectively.

PepsiCo and Mondelez together account for ~1.2% of the portfolio holdings of the SPDR S&P 500 ETF (SPY). PepsiCo and Kellogg together account for ~1.4% of the portfolio holdings of the iShares Russell 1000 Growth ETF (IWF).

Improve margins

Mondelez’s sale of its coffee business will also help the company integrate its supply chain across its snack business and bring down costs. The company aims to reduce its annual operating costs by at least $1.5 billion by the end of its restructuring plan for the 2014–2018 period.

Exposure to growth in the coffee market

Mondelez holds a 44% stake in Jacobs Douwe Egberts, the new coffee joint venture. This should allow the company to have exposure to growth in the global coffee market through a joint venture with expertise in the coffee business.

In the next part of this series, we’ll see how the new joint venture will affect competition in the coffee industry.