An Overview of D.R. Horton’s Homebuilding Segment

The homebuilding segment of D.R. Horton, which mainly focuses on single-family attached and detached homes, is divided into six divisions.

July 21 2015, Published 12:25 p.m. ET

Homebuilding divisions

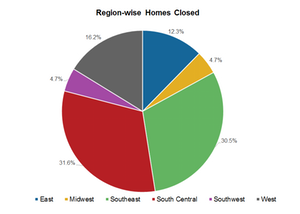

The homebuilding segment of D.R. Horton, which mainly focuses on single-family attached and detached homes, is divided into six divisions: East, Midwest, Southeast, South Central, Southwest, and West.

South Central is D.R. Horton’s largest division in terms of homes closed, with a share of 31.6%, followed by the Southeast region with 30.5%, and the West region with 16.2%. The company builds homes in sizes ranging from 1,000 to more than 4,000 square feet and in the price range of $100,000 to over $1,000,000.

Geographic diversification lowers operational risks

D.R. Horton’s (DHI) homebuilding business began in the Dallas/Fort Worth area, which is still one of its largest local homebuilding operations. Since then, the company has expanded to other markets and currently operates in 27 states and 79 metropolitan markets of the United States. D.R. Horton’s geographic exposure now extends from Texas to the Southeast and the Mid-Atlantic, and through the West Coast and Southwest. The company has minimal exposure in the upper Midwest or the Northeast.

D.R. Horton (DHI) is more geographically diversified compared to its major competitors like Lennar (LEN) and Pulte Group (PHM). Lennar (LEN) operates in 18 states while Pulte Group (PHM) operates in 29 states. The geographic diversification lowers operational risks by mitigating the effects of local and regional economic cycles.

Investors looking for diversification in the homebuilding sector can consider ETFs such as the SPDR S&P Homebuilders ETF (XHB) and the iShares Dow Jones US Home Construction Index Fund (ITB).